Staking can be compared to a bank deposit, but only much more profitable and technologically advanced. Instead of just storing cryptocurrency in a wallet with nothing to do, you “freeze” it for a certain period of time and receive regular rewards — from 5% to 25% per annum, depending on the chosen coin and platform.

Data Pocket Option shows that staking users, on average, increase their capital 180% faster than those who simply keep cryptocurrencies idle. At the same time, 89% of participants in the staking say that it helps them to maintain discipline and not succumb to emotional decisions about asset sales.

Experts The Trading Academies conducted a large-scale study and found out that the right combination of staking with active trading strategies allows you to increase the total return on your portfolio by 340% compared to simple “hodling” of cryptocurrencies.

What is “Proof of Stake” (PoS)?

Staking is based on the “Proof of Stake” consensus mechanism, which is fundamentally different from the usual Bitcoin mining. If mining requires powerful computers that solve complex mathematical problems, then PoS works on the principle of “the more coins you have, the more you can earn.”

In networks with the PoS algorithm, validators (participants confirming transactions) are selected not based on computing power, but depending on the number of coins they are willing to “freeze” as collateral. This creates a natural interest in honest work, because if a validator tries to cheat the system, he will lose his deposit.

The basic principles of PoS operation include the following elements:

- Staking as a pledge. Participants block their coins, demonstrating their seriousness of intentions and willingness to take responsibility.

- Random selection. The system randomly selects validators to confirm the blocks, but taking into account the size of their share.

- Rewards for honesty. Validators receive new coins and commissions for their correct work.

- Penalties for violations. In case of fraud attempts, some or all of the blocked funds are confiscated.

This mechanism makes the network more energy efficient compared to mining and at the same time provides coin holders with the opportunity to receive passive income. Ethereum, the second largest cryptocurrency by capitalization, completely switched to PoS in 2022, which confirms the viability of this approach.

Why is staking more profitable than a bank deposit

A comparison of bank deposits and staking shows a dramatic difference in potential profitability and terms of funds placement. Modern bank deposits in most countries offer returns of 2-8% per annum, while staking can bring 8-25% per annum in stablecoins and up to 50-100% in more volatile tokens.

The key advantages of staking over bank deposits:

- High profitability. The average profitability of staking is 3-5 times higher than bank rates.

- Global accessibility. You can participate from anywhere in the world without bureaucratic procedures.

- Flexible terms. There are many options for deadlines and minimum amounts.

- Innovative opportunities. Access to new technologies and projects at an early stage.

- The absence of intermediaries. Direct interaction with the protocol without bank fees.

However, staking also carries additional risks related to the volatility of cryptocurrencies and the technological features of blockchain networks. Stablecoins partially solve the problem of volatility by offering a yield of 8-15% per annum with minimal exchange rate fluctuations.

A practical comparison example: A bank deposit of $10,000 at 5% per annum will bring in $500 in income per year. The same amount of USDT staking at 12% will generate $1,200 in revenue, which is 2.4 times more with a comparable level of currency stability.

On the platform Pocket Option flexible staking programs are available with the possibility of early withdrawal and reinvestment of income, which makes this tool even more attractive compared to traditional deposits.

What are Liquid Staking Tokens

Liquid Staking Tokens (LST) represent a revolutionary solution to the main problem of traditional staking — the inability to use blocked assets for other operations. When you stake regular tokens, they are “frozen” for a certain period of time and are unavailable for trading or other operations.

LSTs solve this problem by issuing receipt tokens to the user in exchange for blocked assets. These tokens can be freely traded, used in DeFi protocols or as collateral, while continuing to receive income from the staking of the original coins.

The principle of operation of liquid staking is as follows:

- Deposit of original tokens. The user transfers ETH or other PoS tokens to the liquid staking protocol.

- Getting the LST. In return, the user receives stETH, rETH, or similar derivative tokens.

- Accumulation of rewards. LSTs automatically increase in value due to the accumulation of staking rewards.

- Flexible usage. LST can be traded, used in DeFi, or converted back to the original tokens.

Popular liquid staking protocols include Lido (stETH), Rocket Pool (rETH), and Coinbase (cbETH). These platforms ensure a high level of security and transparency of operations by regularly undergoing independent audits of smart contracts.

Liquid staking is especially popular among active traders who want to earn passive income, but are not ready to completely exclude their assets from circulation. The LST yield is usually 1-2% lower than that of direct staking, but the additional liquidity makes up for this difference.

Advantages and disadvantages of cryptocurrency staking

Staking as an investment strategy has its strengths and limitations, which are important to understand before starting to participate.

The main advantages of staking include:

- Passive income. Staking brings regular payouts without the need for active actions on the part of the user.

- Network support. Participants contribute to the security and decentralization of blockchain protocols.

- Compound interest. The ability to automatically reinvest income for accelerated capital growth.

- Protection against inflation. The profitability of staking often exceeds the inflation rate in a traditional economy.

- Risk diversification. Various protocols and tokens allow you to distribute attachments.

Potential disadvantages and risks of staking:

- Funds are blocked. Many protocols require tokens to be frozen for a fixed period.

- The risk of cost reduction. The drop in the exchange rate of the tokens being staked may exceed the income received.

- Technical risks. Errors in smart contracts or attacks on the protocol can lead to loss of funds.

- The risk of slashing. In some networks, validators may lose some of their funds for violating the rules.

- Regulatory uncertainty. Changes in legislation may affect the availability of staking.

To minimize risks, it is recommended to diversify between different protocols, choose proven platforms with a good reputation, and constantly monitor changes in the ecosystem.

How to calculate the percentage of remuneration

Calculating the profitability of staking requires understanding several key indicators and their interrelationships. The Annual Percentage Yield (APY) is the main indicator that takes into account the effect of compound interest on income reinvestment.

The basic formula for calculating APY is as follows:APY = (1 + r/n)^n – 1, where r is the nominal interest rate and n is the number of capitalization periods per year.

A practical example of a staking calculator:

Initial amount: $5,000 in USDT APY: 12% Period: 1 year Payout frequency: daily

- Daily return: 12% / 365 = 0.0329%

- Income for the first day: $5,000 × 0.000329 = $1.64

- Amount after the first day: $5,001.64

- The total amount in a year: $5,000 × (1 + 0.12/365)^365 = $5,637.48

- Net income: $637.48

Many exchanges provide built-in staking calculators that automatically calculate the expected income, taking into account all the parameters. A convenient calculator is available on Pocket Option, which allows you to compare the profitability of various staking programs and choose the optimal strategy.

Additional factors affecting the calculation:

- The platform’s fees. Most services retain 5-25% of the rewards.

- Minimum amounts. Some programs require a minimum deposit to participate.

- Withdrawal dates. Early withdrawal of funds may result in fines or loss of accumulated income.

- The volatility of tokens. A change in the exchange rate of the underlying asset affects the final return in the fiat equivalent.

How to lock up cryptocurrency, what tools are needed for this

The staking process has become much easier with the advent of specialized platforms and integrated solutions from major exchanges. Modern tools allow you to start staking in just a few clicks.

The main types of staking platforms are:

- Centralized exchanges. Binance, Coinbase, and Kraken offer simple staking programs with guaranteed returns.

- Decentralized protocols. Lido, Rocket Pool, Marinade provide direct interaction with blockchain networks.

- Specialized wallets. Trust Wallet and Atomic Wallet support native staking of various tokens.

- Brokerage platforms. Pocket Option offers integrated staking solutions with additional trading capabilities.

Step-by-step process for starting staking:

- Choosing a platform. Compare the profitability, minimum amounts, and terms of different services.

- Registration and verification. Complete the KYC procedure on the selected platform.

- Adding funds to your account. Transfer the selected cryptocurrency to the platform.

- Program selection. Decide on the type of staking (flexible or fixed).

- Confirmation of the operation. Confirm the funds are blocked and start earning income.

Popular wallets with integrated staking:

- Trust Wallet supports staking of 15+ cryptocurrencies with an APY of 5% to 23%.

- Atomic Wallet offers staking of more than 10 tokens with automatic payment of rewards.

- Exodus provides a simple interface for staking popular PoS tokens.

- Coinbase Wallet is integrated with DeFi protocols for enhanced staking capabilities.

The choice of tool depends on your goals: exchange programs are suitable for maximum simplicity, decentralized protocols are suitable for full control over funds, and specialized platforms such as Pocket Option are suitable for combining staking with active trading.

Staking and liquidity pools

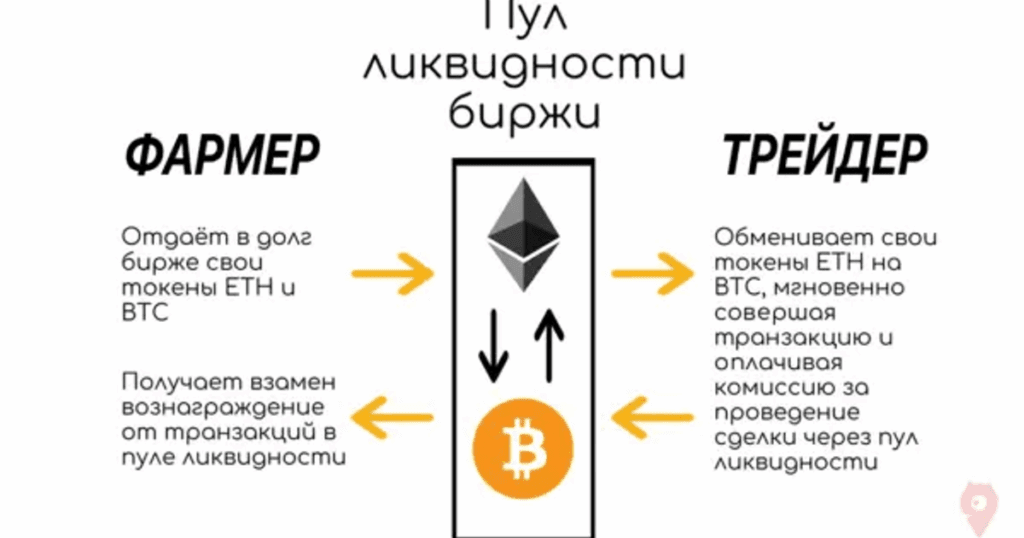

Liquidity pools are an alternative form of passive earnings in the DeFi ecosystem, which is often combined with staking to maximize profitability. Unlike classic single token staking, participation in liquidity pools requires the provision of two tokens in equal proportions.

The principle of operation of liquidity pools is as follows:

- Provision of tokens. Users deposit two tokens (for example, ETH and USDC) into a smart contract.

- Receiving LP tokens. In return, users receive tokens from the liquidity provider (LP-tokens).

- Earning on commissions. Income is generated from trading commissions of DEX users.

- Additional remuneration. Many protocols pay extra with their own tokens to provide liquidity.

The main differences between staking and liquidity pools:

- The number of tokens. Staking requires one token, and liquidity pools require two.

- Source of income. Staking depends on the network’s inflationary rewards, and pools depend on trading commissions.

- The risk of non-permanent loss. In liquidity pools, there is a risk of impermanent loss when the price ratio of tokens changes.

- The complexity of management. Liquidity pools require more active monitoring and position management.

Many experienced investors combine different strategies: they stake stable assets for guaranteed income and provide liquidity to high-yield pools for additional profits. The Pocket Option platform offers tools for effective management of such combined strategies.

Risks

Staking, despite its attractiveness, carries a number of specific risks that are important to understand and consider when planning investments.

The main risk categories in staking include:

- Technological risks. Errors in the code of smart contracts, attacks on the protocol, or problems with validators can lead to partial or complete loss of funds.

- Market risks. The drop in the value of the tokens being staked can significantly exceed the rewards received, especially during bear market periods.

- Liquidity risks. Blocking funds for a long period limits the ability to respond quickly to market changes.

- Operational risks. Problems with the platform, maintenance, or changes in terms may temporarily disrupt the revenue generation process.

- Regulatory risks. Changes in the legislation of different countries may limit access to staking or affect its taxation.

Specific risks of different types of staking:

Native staking involves direct interaction with the blockchain protocol and requires technical knowledge. Risks include incorrect validator configuration and possible slashing (penalties for violating network rules).

Margin staking uses borrowed funds to increase the size of the position, which multiplies both the potential profit and possible losses. This type of staking is suitable only for experienced investors with a high tolerance for risk.

Liquid staking adds risks associated with smart contracts of intermediary protocols and potential price discrepancies between the original tokens and their derivatives.

Risk minimization methods:

- Diversification between different protocols and tokens.

- A selection of proven platforms with a good reputation and insurance mechanisms.

- A gradual build-up of positions with the study of the specifics of each protocol.

- Regular monitoring of changes in the ecosystem and timely strategy adjustments.

- Reserving a portion of funds in liquid assets to quickly respond to market changes.

Pocket Option staking and additional capital increase strategies

The Pocket Option platform provides unique opportunities for combining staking with active trading strategies, which allows maximizing investment returns with a controlled level of risk.

Advantages of staking on Pocket Option:

- Flexible terms. Minimum amounts starting from $10 and the possibility of early withdrawal without penalties.

- High profitability. APY is up to 18% for stablecoins and up to 35% for alternative tokens.

- Automatic capitalization. Daily accrual and reinvestment of income for maximum compound interest effect.

- Integration with trade. The ability to use part of the funds for active operations without interrupting staking.

- Insurance coverage. The compensation fund covers the technical risks of the platform.

Combined capital increase strategies:

The “Stable Core + active Trading” strategy involves placing 60-70% of funds in stablecoin staking to generate guaranteed income, and the remaining 30-40% is used for active trading operations with potentially higher returns.

The “Ladder of Profitability” strategy includes the allocation of funds between various staking programs with different terms and rates, which ensures a regular inflow of funds and the possibility of their reinvestment in more favorable conditions.

The arbitration strategy uses the difference in the profitability of staking on various platforms, automatically moving funds to where the conditions are most favorable at the moment.

The experts of the Trading Academy have developed specialized courses that teach an effective combination of staking with various trading strategies. Program participants increase their total profitability by 280% on average compared to using staking alone.

The educational opportunities of the Academy include:

- Practical seminars on optimizing staking strategies.

- Individual consultations on creating a diversified portfolio.

- Access to private analytical materials and market forecasts.

- A community of like-minded people to share experiences and ideas.

- Regular webinars with leading experts of the DeFi industry.

Combining staking on Pocket Option with educational programs The Trading Academy creates a synergistic effect that allows investors not only to receive passive income from staking, but also to develop active money management skills to achieve financial independence.

Cryptocurrency staking is a powerful passive income tool that, if applied correctly, can become the foundation for long-term financial well-being. Start with small amounts, explore various opportunities and gradually build up your position using proven platforms and educational resources.