Futures are one of the most powerful, but also risky, instruments in the financial markets, allowing one to profit from rising and falling prices using leverage. Experts at Trading Academy emphasize that understanding the mechanics of futures is critical to successful trading—they’re not just leveraged stocks, but a separate class of derivative instruments with their own specific features.

Futures are traded on cryptocurrency exchanges like Bybit, traditional platforms like Moscow Exchange, and simplified platforms like Pocket Option. This article explains in simple terms what futures are, how they work, where to trade, and how to minimize risks when using this instrument.What are futures in simple terms

A futures contract is an agreement between two parties to buy or sell something in the future at a price set today. Imagine: today is March, and Bitcoin is trading at $60,000. You buy a futures contract expiring in June at $61,000. If Bitcoin costs $65,000 in June, you earn the difference ($4,000); if it costs $58,000, you lose ($3,000).

The main difference from a regular purchase:

- When you buy a share, you physically own it—it’s your property.

- When you buy a futures contract, you do not own the asset, but only the right to a transaction in the future.

- A futures contract requires only a small portion of the full value—this is called margin or collateral.

- Futures have an expiration date—they are not infinite.

A real-life example: a farmer sells futures on wheat in the spring while it’s still growing. He fixes the price at $200 per ton. In the fall, when the harvest is harvested, the price could be $150 (the farmer makes a profit, selling at a higher price) or $250 (the buyer makes a profit, buying below market price). Both parties are protected from unexpected fluctuations.

In financial markets, futures work the same way, only instead of wheat, they trade stocks, currencies, indices, oil, gold, and cryptocurrencies.

Other Important Trading Terms

Underlying asset is what the futures contract is based on. This could be a stock (Sberbank), an index (S&P 500), a currency (dollar), a commodity (oil), or a cryptocurrency (Bitcoin).

Contract size—the amount of the underlying asset in one futures contract. For example, a Si (dollar/ruble) futures contract on the Moscow Exchange is $1,000, while a BTC futures contract on Bybit can be any size, starting from fractions of a coin.

Margin (collateral) is the money the exchange locks in for your position. This isn’t the full contract value, but only a portion—usually from a few percent to 20-30%, depending on the asset and leverage settings.

Leverage is how many times your position is larger than your capital. Leverage of 10x means that with $1,000, you control a $10,000 position. Profits and losses are multiplied by 10.

Long — buying a futures contract betting on a price increase. You opened a long position at $50,000, the price rose to $52,000, and you earned $2,000 (plus leverage).

Short — selling a futures contract betting on a fall. You opened a short at $50,000 and the price fell to $48,000, earning $2,000. If the price rose, you lost.

Liquidation is the forced closure of a position by the exchange when your losses reach a critical level. You can lose all your collateral in a matter of minutes during a sharp move.

Funding – in cryptocurrency perpetual futures, this is a periodic payment between long and short positions every 8 hours to balance the futures price with the spot.

Stop-loss is an automatic order to close a position when a certain price is reached to limit losses.

Take Profit — automatic closing of a position when the target profit is reached.

Futures Expiration

Expiration is the date on which a futures contract expires and must be executed or settled. This is the key difference from perpetual instruments.

Types of futures by expiration:

- Quarterly — expire quarterly (March, June, September, December). Popular on the Moscow Exchange.

- Monthly — every month. Often found on crypto exchanges.

- Weekly – short-term for active traders.

- Perpetual contracts are not actually futures in the classic sense, but they behave similarly. They have no expiration date and are popular in crypto.

What happens at expiration:

On traditional exchanges (Moscow Exchange, CME):

- Settled futures—the position is closed automatically at the settlement price, and any profit or loss is credited to the account. There is no physical delivery.

- Delivery futures – where the actual asset is transferred (rare for retail traders).

On crypto exchanges (Bybit, Binance):

- Quarterly/monthly contracts close automatically at the index price at expiration.

- Perpetual contracts have no expiration date and are traded indefinitely.

Important: 3-5 days before expiration, the current contract’s liquidity drops, and all positions are carried over to the next month. Spreads widen, and unexpected movements are possible. Close positions early or rollover to the next contract.

Liquidation Risks: How Not to Lose Everything

Liquidation is the worst-case scenario in futures trading. The price moves sharply against you, your collateral runs out, and the exchange forcibly closes your position. You lose all your allocated margin.

How does liquidation occur:

- Opened a position with 10x leverage for $10,000 (control $100,000).

- The price went against you by 10%.

- Your loss = $10,000 (100% margin).

- The exchange automatically closes the position to avoid going into the red.

- You lost all your margin in one move.

Risk factors:

- High leverage (10x-50x) – liquidation occurs quickly.

- Low asset liquidity—sharp price fluctuations.

- No stop-loss—hoping for a reversal instead of limiting your losses.

- Trading during news breaks – volatility is off the charts.

- Multiple positions at the same time – risks are cumulative.

How to protect yourself:

- Use low leverage – start with 2-3x, maximum 5-10x.

- Always set a stop-loss at 30-50% of the distance before liquidation.

- Keep 40-50% of your deposit free, don’t enter with your entire capital.

- Trade liquid pairs (BTC, ETH, majors on the Moscow Exchange).

- Avoid trading during important news releases without a clear plan.

The golden rule: if your stop-loss is at 5% of your loss, your liquidation should be no closer than 10-15%. This provides a margin of safety.

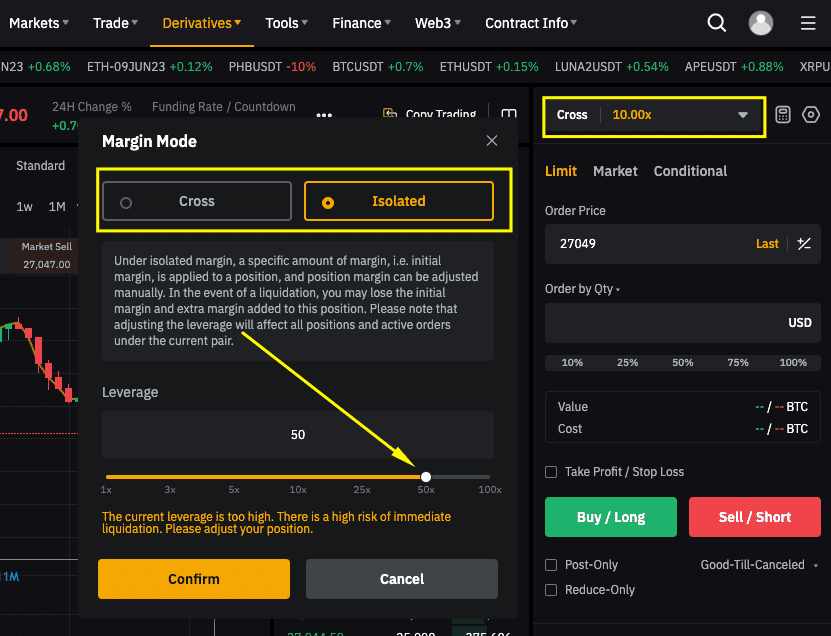

Bybit interface with leverage settings and liquidation indicators

How to Use Cryptocurrency Futures

Crypto futures are the most popular way to trade cryptocurrencies with leverage. Available on Bybit, Binance, OKX, Bitget, and other CEX exchanges.

Features of crypto futures:

- Open 24/7, 7 days a week – trade whenever you want.

- High volatility—Bitcoin can move 10-20% in a day.

- Perpetual contracts without expiration are popular.

- Funding bets every 8 hours between long and short.

- Very high leverage is available, up to 100x-125x (extremely dangerous).

Trading process:

- Register on an exchange (Bybit, Binance).

- Pass KYC for full access.

- Fund your account with USDT or another stablecoin.

- Transfer to Derivatives/Futures Account.

- Choose a pair (BTCUSDT Perpetual).

- Set up your leverage (2-5x recommended to start).

- Open a Long (bet on growth) or Short (bet on decline).

- Place a stop loss and take profit.

- Monitor your position—funding is debited every 8 hours.

- Close manually or when TP/SL is reached.

Popular pairs:

- BTCUSDT — the most liquid, tight spreads.

- ETHUSDT is the second most popular, with good volatility.

- BNBUSDT, SOLUSDT, and AVAXUSDT are top altcoins.

- Memcoins (DOGEUSDT, PEPEUSDT) – Extreme Volatility

Beginners are advised to start only with BTC and ETH—they offer higher predictability and less slippage.

How to Use Futures in Stocks and Bonds

Stock and index futures are traded on traditional exchanges: Moscow Exchange (FORTS), CME, Eurex.

Characteristics of traditional futures:

- The trading session is limited to the exchange’s operating hours (not 24/7).

- Quarterly or monthly expiration.

- Strict regulation and supervision.

- Variation margin is debited daily (for Russian exchanges).

- Taxes are withheld automatically by the broker.

Popular futures on the Moscow Exchange:

- Si (dollar/ruble) is the most liquid.

- RTS and MIX (index futures).

- Stock futures (Sber, Gazprom, Lukoil).

- Gold, Brent crude oil.

Trading process:

- Open a brokerage account with access to FORTS.

- Install the terminal (QUIK, MetaTrader, web version).

- Replenish your account (you need a reserve for GO + variation margin).

- Select a futures contract (for example, Si-6.25 – expiration June 2025).

- Check the specifications—contract size, GO, price increment.

- Place an order (limit or market).

- Set a stop-loss.

- Keep an eye on your variation margin—it’s debited every day.

- Close the position before expiration or hold it until auto-close.

Bond futures are a specialized instrument for professionals. They are traded on OFZ (federal loan bonds) and Eurobonds. They are more difficult to understand due to duration, coupons, and pricing peculiarities. Not recommended for beginners.

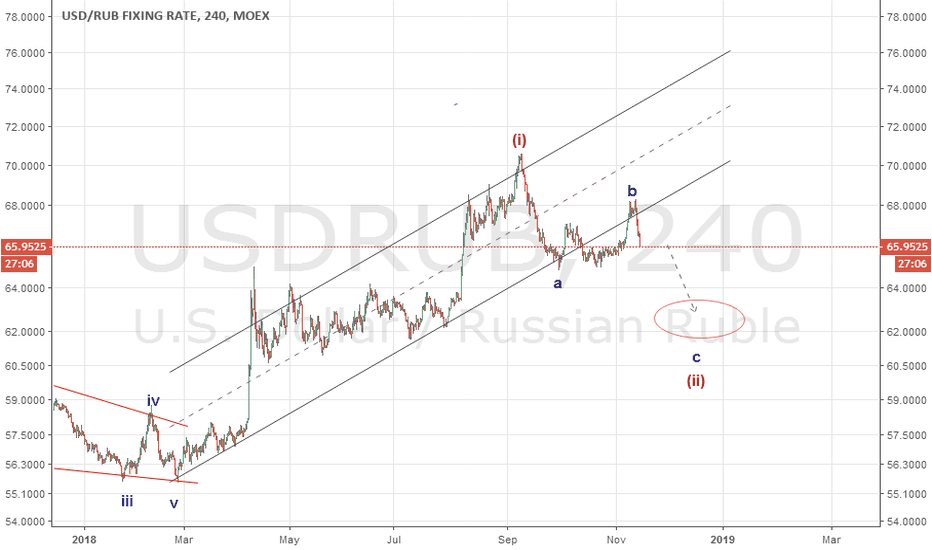

Si futures chart with support/resistance levels

Suitable exchanges for futures trading

Cryptocurrency exchanges:Bybit is the best choice for CIS markets. Intuitive interface, low fees, wide selection of pairs. Leverage up to 100x (use with caution). Demo mode available for practice.

Binance is the largest exchange by volume. It offers the widest selection of futures (100+ pairs). Competitive fees. Not available in some countries.

OKX — advanced tools for professionals. Good liquidity. Not available in the UK, US, or Canada.

Bitget is a growing exchange with a liquidation insurance program. Suitable for intermediate users.

Traditional exchanges:Moscow Exchange (FORTS) — for trading Russian futures. Broker required: T-Bank, BCS, Finam, VTB, Sber Investor.

CME Group is the largest exchange in the United States. Futures on the S&P 500, Nasdaq, and commodities. Access through international brokers.

Eurex is a European exchange. German indices DAX, Euro Stoxx. For qualified investors.

When choosing, consider:

- Liquidity of the required pairs.

- Commission amount.

- Availability in your country.

- Quality of technical support.

- Availability of training materials.

Step-by-step instructions for trading on Bybit

Bybit is the most popular crypto exchange in the CIS for futures trading. Let’s break it down in detail.

Step 1. Registration Go to the Bybit website and register via email or phone number. Complete KYC (upload your passport) to access full functionality.

Step 2. Fund your account Deposit USDT via bank card, P2P, or transfer from another exchange. The minimum amount to start is the equivalent of $50-100.

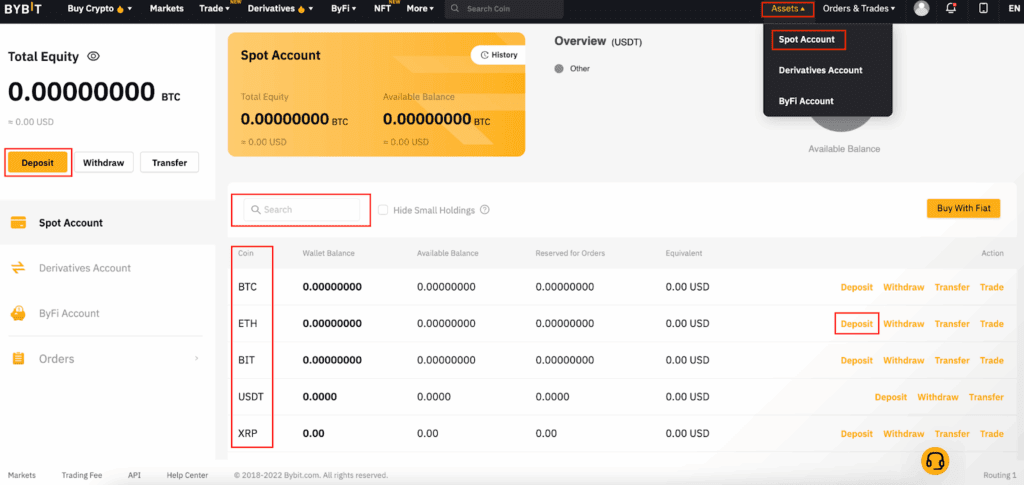

Fund Bybit using various methods

Step 3. Transfer to Derivatives In the Assets section, transfer USDT to your Derivatives Account. Futures are only available there.

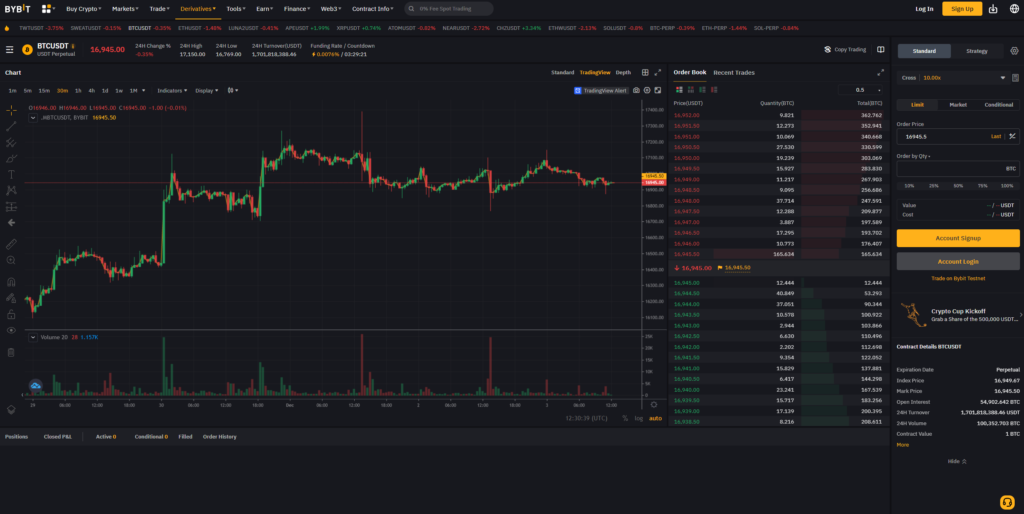

Step 4. Opening the trading terminal Click “Derivatives” → “USDT Perpetual”. The trading interface will open.

Bybit trading terminal with order panel and chart

Step 5. Select a pair In the upper left corner, click on the current pair (for example, BTCUSDT). Select the desired one from the list.

Step 6. Setting the leverage To the right of the pair name, you’ll see the leverage (for example, “10x”). Click it and set a conservative 3-5x to start.

Step 7. Selecting a Margin Type Isolated — the risk is limited to the allocated amount. Cross — the entire balance is used as collateral. For Beginners, see Isolated.

Step 8. Placing an order The order panel is on the right. Select the type:

- Market – instantly at the current price.

- Limit — at the price you specify.

Enter your position size. Click “Buy/Long” (green) or “Sell/Short” (red).

Step 9. Setting TP/SL After opening a position, find the three dots on the right in the “Positions” section. Select “Set TP/SL.” Specify your take profit and stop loss levels.

Step 10. Monitoring Monitor your PNL (profit/loss), funding, and margin levels. Close the position using the “Close” button or wait for the TP/SL to trigger.

How trading works on Pocket Option

The Pocket Option platform offers a simplified approach to derivatives with fixed expirations ranging from minutes to hours.

Key differences:

- Simplified interface without complex terminals.

- The fixed profit/loss potential is known in advance.

- Short contracts 60 seconds – several hours.

- There is no leverage in the classical sense.

- There is no risk of unexpected liquidation.

- Demo account for risk-free practice.

Critical Note: In countries of the European Economic Area (including Germany), trading binary options and certain derivatives for retail investors is prohibited by ESMA. Services are not available to residents of the EEA, the UK, the US, and certain other jurisdictions. Be sure to check the legality of use in your country.

Can I close a position before expiration?

This is standard practice. Most traders close their positions well before the expiration date.

Methods of early closure:

- Reverse trade – you sell the futures contract you bought or buy the futures contract you sold.

- The Close button is located in the terminal next to the position. Instant market closure.

- Stop-loss/take-profit — automatic closing when levels are reached.

- Partial closing – you can close not the entire position, but 50%, for example.

You can close:

- At any time during the trading session.

- Many times a day (scalping).

- Upon reaching the profit target.

- When the market situation changes.

When it is necessary to close:

- 3-5 days before expiration, liquidity falls and spreads increase.

- When you reach your stop-loss, don’t expect a reversal.

- Before important news – if you don’t want to risk volatility.

- When the trading plan or technical picture changes.

You should hold until expiration only if it is part of a strategy (calendar spreads, long-term hedging).

Calculator: Example of a Transaction Calculation

Let’s calculate a Bitcoin futures trade on Bybit.

Initial data:- BTC Price: $60,000

- Deposit: $1,000

- Shoulder: 5x

- Position size: $5,000 (entirely available with leverage)

- Type: Long (growth bet)

Step 1. Determine the amount of BTC $5,000 / $60,000 = 0.0833 BTC controllable.

Step 2. Calculate the stop-loss We want to risk 2% of the deposit = $20. With 5x leverage, a loss of $20 = a price move of $20 / 0.0833 BTC = $240 per BTC. Stop-loss: $60,000 – $240 = $59,760. This is 0.4% of the entry price.

Step 3. Determine the take profit Risk/Reward 1:3. Risk $20, target $60. Movement: $60 / 0.0833 BTC = $720 per BTC. Take profit: $60,000 + $720 = $60,720. This is 1.2% of the entry price.

Step 4. Checking the Liquidation With 5x leverage, the liquidation at approximately -20% is $48,000. Our stop-loss of $59,760 will be triggered much earlier. The safety margin is huge.

Step 5. Consider fees and funding The taker fee is usually 0.055% x 2 (entry and exit) = 0.11% of $5,000 = $5.5. Funding depends on the rate (usually ±0.01% every 8 hours). Over the course of a day, it’s approximately ±$1.5.

Final calculation:- Risk: $20

- Potential profit: $60 – $5.5 – $1.5 ≈ $53

- Risk/Reward: 1:2.65 after costs

- Probability of liquidation: minimal (requires a drop of -67%)

Possible trading tactics

Scalping — dozens of trades a day, holding for seconds to minutes. Catch small movements of 0.1-0.5%. Requires constant presence and quick reactions. High commissions eat into profits.

Day trading — 3-10 trades per day, closing all before the end of the session. Analyze intraday trends. Avoid overnight gaps and funding. Aim for 1-3% per day.

Swing trading — hold for 2-7 days. Catch mid-range swings based on technical analysis. Consider crypto funding or variation margin on the Moscow Exchange.

Positional trading—weeks and months. Follow the trend, ignoring the noise. You need a large deposit to survive drawdowns. Consider expiration—rollover.

Hedging is a way to protect your core portfolio. Hold stocks long-term, but open short futures when you anticipate a correction. Losses on stocks are offset by profits on shorts.

Arbitrage is the simultaneous buying and selling of trades on different exchanges to profit from price differences. It requires fast execution and sufficient capital.

Calendar spread—buying one month’s futures and selling another. Earning on the price difference between contracts. For experienced traders.

What to Use to Maximize Profits

Technical Analysis – The Foundation for Futures:Support and resistance levels are prices where the market often reverses. Go long from support and short from resistance.

Trend lines—draw them based on highs and lows. Trade in the direction of the trend: buy in an uptrend, sell in a downtrend.

Indicator:

- MA (moving averages) – trend determination.

- RSI — overbought (>70) and oversold (<30).

- MACD — trend reversal signals.

- Volumes confirm movements.

Candlestick Analysis Patterns:

- Head and Shoulders – trend reversal.

- Double bottom/top are reversal signals.

- Flags and pennants continue the trend.

For cryptocurrencies:

- SEC Regulatory Decisions

- Bitcoin halving.

- Adoption by large companies.

- Exchange hacks, project scams.

For stocks and indices:

- Central Bank decisions on the key rate.

- Company earnings reports.

- Geopolitics, sanctions.

- Macroeconomic statistics (GDP, inflation).

For products:

- OPEC+ Oil Production Solutions

- Weather for agricultural products.

- Industrial demand for metals.

Combined approach: Fundamentals determine direction (where the market will go), while technicals determine entry/exit points (when to enter). Don’t trade during important news releases without experience—volatility kills stop-losses.

Futures Trading Examples

Example 1. Long position on the rise of BitcoinSituation: Bitcoin is consolidating at $58,000 after a decline. The RSI is showing oversold conditions, and volumes are rising. Expect a rebound to $62,000.

Actions:

- Opened a long position for $58,000 with 3x leverage.

- Position size $3,000 with a deposit of $1,000.

- Stop loss $57,400 (risk $20).

- Take profit $62,000 (target $134).

- After 3 days, the price reached $62,000, closing with a profit of $120 after commissions.

Situation: The Fed’s rate decision is tomorrow, a hike is expected. The S&P 500 is at historic highs. Expect a correction.

Actions:

- Opened a short futures contract on the S&P 500 at 4,800 points.

- Size 1 contract ($50 per point).

- Stop loss 4,850 (risk $2,500).

- Take profit 4,700 (target $5,000).

- After the announcement, the market fell to 4,720, closing with a profit of $4,000.

Situation: You’re holding Sber shares for $50,000. You expect a 10% market correction, but you don’t want to sell the shares (long-term position).

Actions:

- Opened a short futures contract on the IMOEX index for $50,000.

- The market fell by 12%, Sber shares -$6,000.

- The futures brought in a profit of +$6,000.

- Final result: zero instead of a loss of $6,000.

- After the correction, you closed the futures contract and continue holding the shares.

Answers to Frequently Asked Questions

Are futures traded on weekends?Depends on the type:

- Cryptocurrency futures – yes, 24/7, 7 days a week.

- Traditional (Moscow Exchange, CME) — no, only on weekdays. Evening sessions can last until late at night.

In Russia:

- Futures on the Moscow Exchange are available to everyone; qualified investor status is not required.

- You only need a brokerage account with access to FORTS.

On crypto exchanges:

- Access is open to everyone after registration and KYC.

- Some countries have restrictions (USA, UK, Canada on some exchanges).

Cryptocurrency (Bybit):

- Minimum $100-200 for meaningful trading with low leverage.

- $500-$1,000 is comfortable for diversification and reserve for drawdowns.

Traditional exchanges (Moscow Exchange):

- Minimum 20,000-50,000 rubles to cover civil liability + reserves.

- Comfortable from 100,000 rubles.

The golden rule: start with an amount you are willing to lose without harming your life.

Differences Between Margin Trading and FuturesMargin trading:

- You borrow from a broker to buy an asset.

- You physically own the asset.

- Pay interest for using borrowed funds.

- You can hold the position indefinitely as long as there is collateral.

Futures:

- You don’t own the asset, you trade the contract.

- Leverage is built into the instrument; no credit is required.

- No interest, but there is funding (in crypto) or VM (on the Moscow Exchange).

- The contract has a term (expiration).

A short position is the sale of a futures contract you don’t own, betting on a price decline.

Mechanics:

- You sell a futures contract for $50,000.

- The price drops to $48,000.

- You buy back for $48,000.

- Profit = $2,000 (plus leverage).

If the price rises to $52,000, you buy back at a higher price, losing $2,000.

Unlike stocks, where you must first borrow from a broker to sell, futures can be sold “out of thin air”—this is a feature of derivatives.

What timeframe is best for trading futures?Depends on tactics:

- Scalping: 1m, 5m – see every move.

- Day trading: 15m, 1h – balance between detail and noise.

- Swing: 4h, 1D – medium waves without excess noise.

- Positional: 1D, 1W – global trends.

Recommended for beginners:

- Start with 1h and 4h – there are fewer false signals there.

- Look at the higher timeframe (1D) to determine the trend.

- Enter on the low (15m, 1h) for accuracy.

Rule: Determine the trend on a timeframe 3-4 times higher than your working one.

How to Trade Futures SpreadsSpread is the simultaneous purchase and sale of related futures to profit from price differences.

Spread Types:

Calendar spread:- Buy June BTC futures.

- Selling September.

- You make money if the price difference (basis) changes in your favor.

- You buy gold futures.

- Selling for silver.

- Bet on a change in the metal price ratio.

- BTC futures on Bybit are trading at $60,100.

- On Binance, $60,000.

- Buy on Binance, sell on Bybit.

- Profit $100 per contract minus commissions.

Spreads are less risky than directional trading, but require an understanding of correlations and sufficient capital.

Setting up QUIK for futures tradingQUIK is the standard terminal for the Moscow Exchange.

Basic setup:

- Download and install QUIK from your broker.

- Log in with your username/password.

- In the “Tables” menu, create “Current Trades.”

- Select the “SPFB” class (futures market).

- Add the desired futures to the list.

Setting up charts:

- Right-click on the tool → “Chart”.

- Configure the timeframe (15m, 1h, 1D).

- Add indicators via the Insert menu.

- Save your workspace.

Trading panel:

- “Order Table” for viewing the order book.

- “Positions” for monitoring open ones.

- “Orders” for managing orders.

Hotkeys:

- F2 — new application.

- Ctrl+F2 — quick request.

- Delete — cancel the application.

Set up notifications about order triggers and margin changes in the “Service” → “Settings” section.

Critical Risk Alerts

Futures are a risky instrument. According to regulators, 74-89% of retail accounts lose money on leveraged derivatives. Most newcomers are liquidated within the first few weeks.

Leverage works both ways. With 10x leverage, you’ll earn 100% on a 10% gain, but you’ll lose everything on a 10% loss. One bad entry, and your deposit is wiped out.

Volatility is deadly. Cryptocurrencies move 10-30% daily—with leverage, this means either doubling your capital or getting liquidated. The market is unforgiving.

Invest only available funds. Never loans, last savings, housing, or medical expenses. Futures are not for capital preservation, only for speculation.

Conclusion

Futures are a powerful tool for profiting from any market movement, but they require a deep understanding of the mechanics, iron discipline, and sound risk management. Success comes to those who spend months learning, testing on demo accounts, and gradually building experience with small amounts.

The Pocket Option platform offers a simplified approach to derivatives for those who prefer a simpler approach. For a fundamental understanding of futures trading, technical analysis, and capital management, explore the educational programs at the Trading Academy, which presents up-to-date secure trading techniques and comprehensive capital protection strategies.