Futures trading on Bybit attracts traders with the opportunity to use leverage and profit from both the rise and fall of cryptocurrencies. Experts at Trading Academy emphasize that proper risk management and an understanding of futures mechanics are critical to long-term success. The exchange offers a wide selection of instruments, various margin types, and flexible leverage settings. The Pocket Option platform also provides access to derivatives with simplified mechanics. In this article, we’ll cover the basics of futures trading, risk mitigation strategies, and step-by-step instructions for trading on PCs and mobile devices.

Futures vs. Spot: What’s the Difference

Spot trading is the purchase of cryptocurrency with immediate delivery. You physically own the asset and can store, transfer, and use it. Profit is only possible from price increases.

Futures are contracts to buy or sell an asset at a future date at a pre-agreed price. You don’t physically own the asset; you trade only price changes.

Key differences between futures and spot:

- Leverage allows you to open positions several times larger than your deposit.

- Short positions provide the opportunity to profit from a decline.

- Funding rates are periodic payments between longs and shorts to balance the price.

- Risk of liquidation if the price moves against the position.

- You don’t need the full amount to buy—just the margin.

You bought Bitcoin on spot for $30,000—you can only profit if the price rises. You opened a short position on futures with 10x leverage—you profit from the decline, using only 10% of the position’s value as collateral.

Pocket Option Futures

The Pocket Option platform offers simplified access to cryptocurrency derivatives trading. The main difference from traditional futures is the fixed expiration of contracts, ranging from a few minutes to hours.

Features:

- Simplified mechanics without the need for margin management.

- The fixed profit and loss potential is known in advance.

- There are no risks of liquidation in the classical sense.

- Minimum entry amounts make the instrument accessible.

Important Warning: In countries of the European Economic Area (including Germany), trading binary options and certain derivatives for retail investors is prohibited by ESMA. Please check the legality of using the platform in your jurisdiction.

Futures Trading Tactics

Basic methods:

- Scalping — quick trades on small price movements. You open and close positions in minutes or hours, aiming for a 0.5-2% profit on each trade. Requires constant presence and quick reaction.

- Day trading is intraday trading without carrying positions over to the next day. You analyze short-term trends and open 2-5 trades per day with a target profit of 2-5%. This reduces the risks of funding and overnight gaps.

- Swing trading—holding positions for several days to weeks. Catch average movements based on technical analysis. Less stress, but requires consideration of funding rates and fundamental factors.

- Hedging – protecting your spot portfolio through short positions in futures. Hold Bitcoin long-term, but short it when you expect a correction, locking in temporary profits.

- Funding arbitrage—profiting from the difference in funding rates between exchanges or between spot and futures. Requires an understanding of the mechanics and sufficient capital.

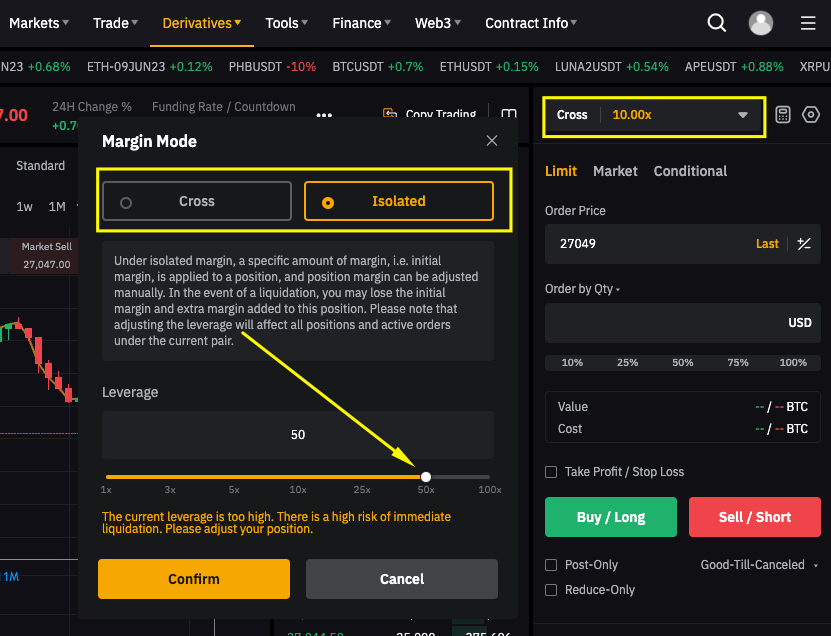

Types of Margin: Isolated and Cross Margin

Isolated Margin—Each position has dedicated collateral. Liquidating one trade does not affect other positions or the account balance.

Advantages of isolated margin:

- Full control over the risk of each position.

- Liquidation is limited to allocated funds.

- Perfect for testing new strategies.

- Protecting your main deposit from one unsuccessful transaction.

Disadvantages:

- You need to manually add margin during a drawdown.

- Liquidation occurs faster with limited collateral.

Cross Margin—the entire available balance is used as collateral for all open positions. The exchange automatically adds margin from available funds during a drawdown.

Benefits of cross margin:

- Positions can withstand large drawdowns.

- Automatically add margin without your intervention.

- Suitable for experienced traders with multiple positions.

Disadvantages:

- Risk of losing the entire deposit upon liquidation.

- It is more difficult to control the risk on individual transactions.

Isolated margin is recommended for beginners—learn to manage risk without the threat of losing your entire account due to one mistake.

Pros and Cons of Futures Trading

Advantages of futures:

- Earn money from any market movement—up or down.

- Leverage increases potential profits from small capital.

- High liquidity on popular pairs ensures fast execution.

- Hedging spot positions to protect against drawdowns.

- You don’t need to physically own the asset to trade.

Disadvantages and risks:

- Leverage also increases potential losses.

- Risk of complete liquidation of the deposit within a few minutes.

- Funding bets can eat into profits on long positions.

- High volatility in the crypto market increases risks.

- Constant monitoring and rapid response are required.

Futures are a tool for those willing to accept high risks for potentially high returns. They are not passive investments, but active trading.

Risks of Futures Trading

Main risks:

- Liquidation is the main danger. The price moves against you, your margin runs out, and the exchange forcibly closes your position. You lose all your allocated collateral.

- Volatility—cryptocurrencies can move 10-20% in a matter of hours. With 10x leverage, this means a complete liquidation or doubling of the deposit.

- Funding bets – when holding positions for a long time, payments every 8 hours can accumulate. If the bet is against you, you lose a percentage of your position daily.

- Slippage—during sharp movements, your strike price may differ significantly from your planned price. This is especially dangerous during liquidation.

- Psychology—leverage amplifies emotions. Fear and greed lead to impulsive decisions: closing profitable positions early or holding on to losing ones for too long.

- Technical failures – exchange unavailability at a critical moment may prevent you from closing a position or adding margin.

How to avoid liquidation

Strategies for protection against liquidation:

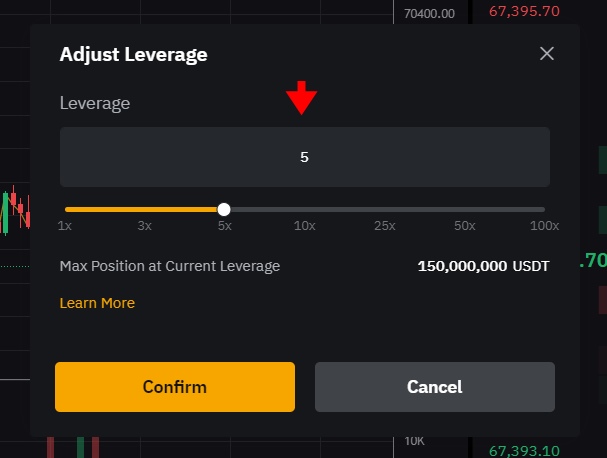

- Use low leverage – start with 2-3x, maximum 5-10x for experienced traders.

- Always set a stop-loss at 30-50% of the distance to liquidation.

- Keep at least 40-50% of your deposit in free margin as a reserve.

- Trade only liquid pairs—BTC, ETH, and major altcoins.

- Do not open positions with all available capital at once.

- Monitor your margin level and add collateral as you approach the danger zone.

- Avoid trading during periods of important news and extreme volatility.

Safety rule: The distance from the entry price to the liquidation should be at least twice your stop-loss. If the stop is at 5% of the loss, the liquidation should be no closer than 10%.

How to Properly Averaging a Position

Averaging is adding to an existing position when the price moves against you. It reduces the average entry price but increases risk.

Rules for safe averaging:

- Plan your averaging in advance, rather than making a decision in a panic.

- Reserve capital—don’t immediately enter into 100% of your planned position.

- Use support/resistance levels for buy points.

- Each average is less than the previous entry – do not double the position.

- Maximum 2-3 averagings, after which close at a loss.

The danger of averaging: it turns a small loss into a catastrophic one. Beginners continue to buy into a falling market until liquidation occurs. It’s better to close with a small loss than to hope for a reversal.

Golden rule: Only average profitable positions to increase profits, not losing ones in the hope of recouping them.

Minimum order size and commission

Minimum order sizes on Bybit vary by pair and change periodically. Typically, they are the equivalent of a few dollars in the contract’s base currency.

Bybit Fee Structure:

- Maker (limit orders) – usually lower, around 0.02% or less depending on VIP level.

- Taker (market orders) – higher, around 0.055% for the base level.

- Funding rates vary from -0.01% to +0.01% every 8 hours, depending on the long/short imbalance.

Commissions seem small, but with frequent trading and leverage, they quickly add up. A scalper with 20 trades per day and 10x leverage pays a significant percentage of their deposit daily.

Calculate the break-even taking into account commissions: if you open and immediately close a position, you’re in the red by double the taker commission. At 0.055%, that’s a 0.11% loss; with 10x leverage, you need a 1.1% price move just to break even.

How to choose a coin for trading

Criteria for choosing a cryptocurrency for futures:

- High liquidity – tight spreads and fast order execution.

- Moderate volatility—enough to make money, but not extreme.

- A clear technical picture – clear support and resistance levels.

- Trading volume availability – avoid pairs with low interest.

- Fundamental stability—no risk of delisting or project scam.

Beginners are recommended to start with BTC and ETH—the most liquid and predictable pairs. Once you’ve mastered the technique, you can add top altcoins.

What to look for:

- Avoid new listings in the early days – extreme volatility.

- Check the news before opening a position—important events can cause sharp movements.

- Look at the overall market trend—most altcoins follow Bitcoin.

- Consider the time of day—the Asian, European, and American sessions have different activity.

Example Coins to Get You Started

This section does not constitute financial advice and is provided for educational purposes only.

Bitcoin (BTC) is the most liquid pair, with relatively predictable movements and clear technical levels. Suitable for learning and first trades.

Ethereum (ETH) is the second most liquid, often showing stronger movements than BTC. Good for moderate risk.

BNB, SOL, AVAX are top altcoins with high liquidity. They are more volatile than BTC/ETH, but manageable for experienced traders.

XRP, ADA, and DOGE are popular coins with medium volatility. They often move based on news and hype.

Start trading with one or two pairs and study their behavior before expanding your list. A deep understanding of one asset is better than a superficial knowledge of ten.

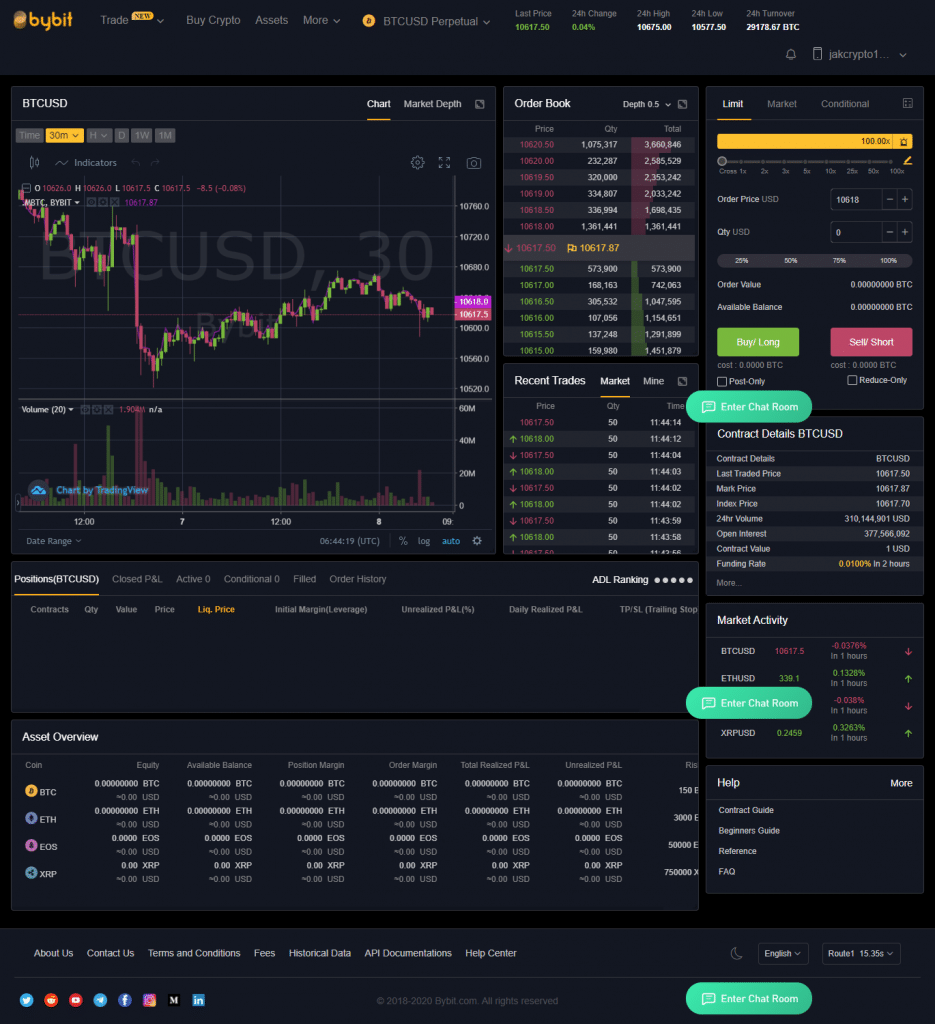

Step-by-Step Guide: Trading on a PC

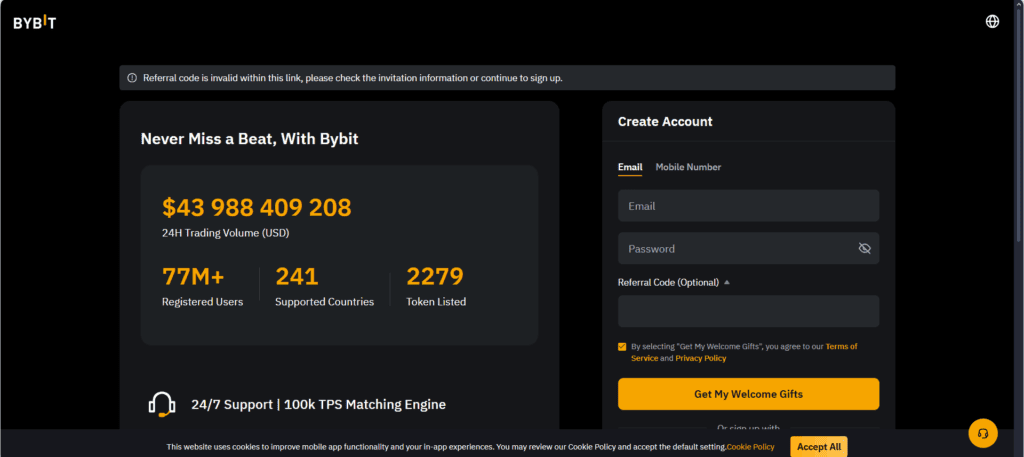

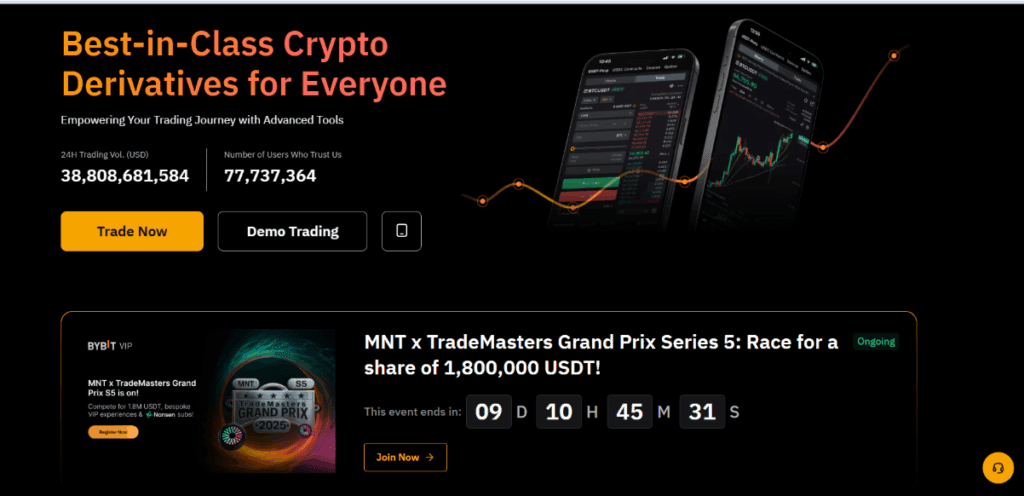

Step 1. Registration and Funding Register with Bybit, complete KYC, and fund your account. Transfer funds to your Derivatives Account via the Assets section.

Bybit’s main page with the registration button

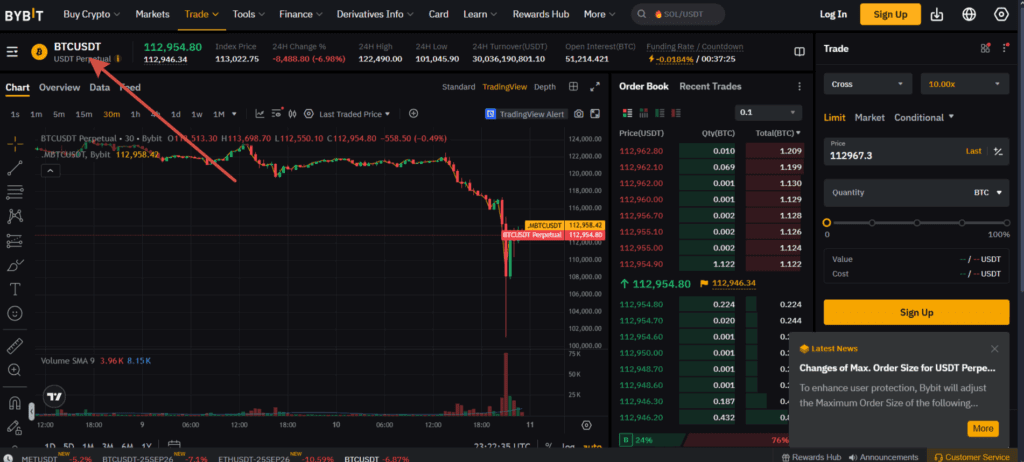

Step 2. Open the trading interface. Click “Derivatives” in the top menu, then select “USDT Perpetual.” The trading terminal will open.

Derivatives menu with contract type selection

Step 3. Select a trading pair. Find the list of pairs in the upper left corner. Click on the current pair (for example, BTC/USDT) and select the desired one from the list.

Drop-down list of trading pairs

Step 4. Leverage Settings. To the right of the pair name, you’ll see the current leverage (for example, “10x”). Click it and set the desired leverage from 1x to the maximum.

Leverage Adjustment Slider

Step 5. Select your margin type. Next to the leverage, select Isolated/Cross. For beginners, select Isolated to control your risk.

Margin Type Switch

Step 6. Placing an order. In the right panel, select the order type (Market/Limit). Specify the position size. For a long position, click the green “Buy/Long” button; for a short position, click the red “Sell/Short” button.

Order placement panel with input fields

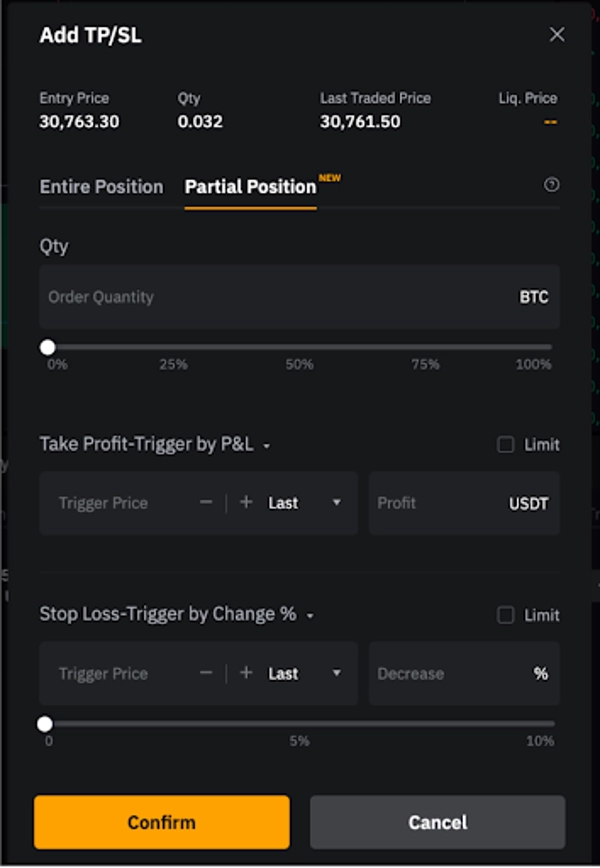

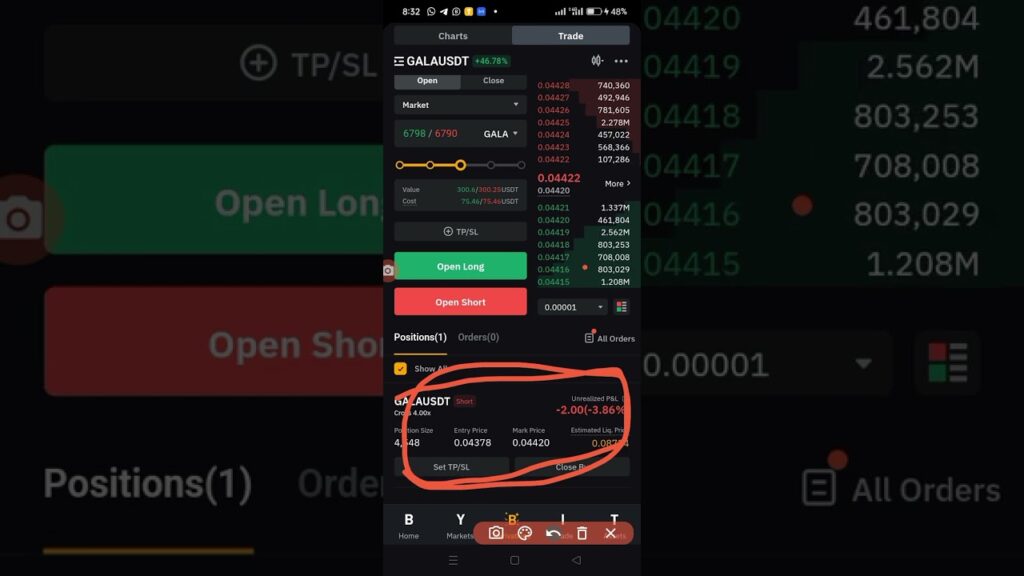

Step 7. Setting Stop Loss and Take Profit. After opening a position, find it in the “Positions” section. Click the three dots on the right and select “Set TP/SL.” Specify the levels.

TP/SL setup window for an open position

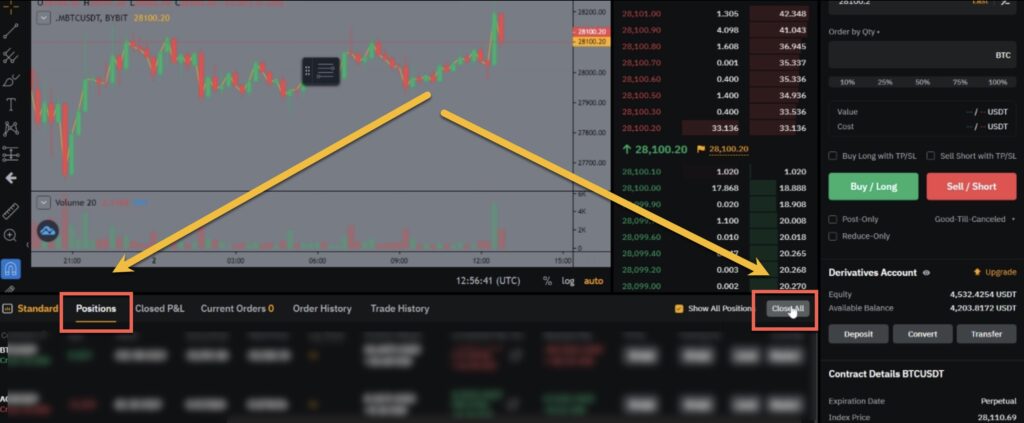

Step 8. Position Monitoring. Track your PNL (profit/loss), margin level, and distance to liquidation in the “Positions” section.

Active positions section with indicators

Step 9. Closing the position. When you are ready to close, click the “Close” button in the Positions section, or place an opposite order of the same size.

Close position button

Trading from a mobile app

Step 1. Install the app. Download the official Bybit app from the App Store or Google Play. Log in to your account.

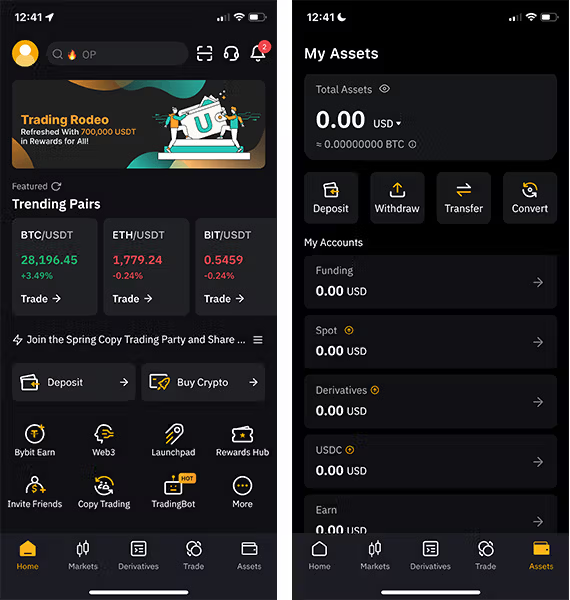

Mobile app home screen

Step 2. Go to Futures. In the bottom panel, select “Derivatives”, then “USDT Perpetual”.

Bottom navigation bar with sections

Step 3. Select a pair and settings. At the top of the screen, tap the pair name to select a different one. Next to it is a button for setting leverage and margin type.

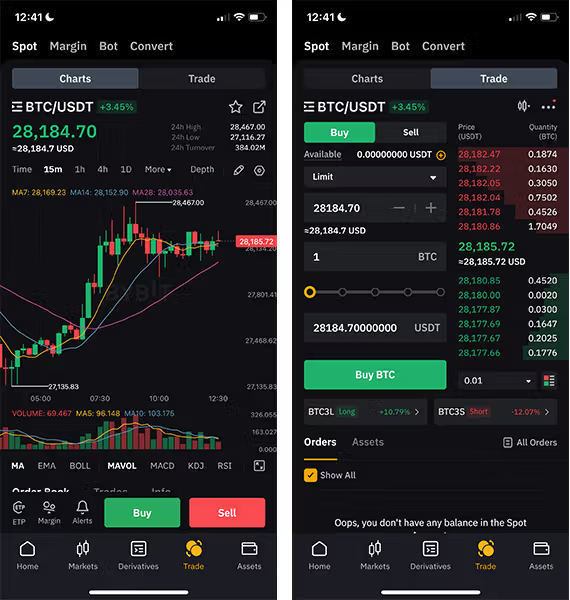

Mobile app trading screen

Step 4. Placing an Order The order panel is at the bottom of the screen. Select the type, enter the size, and swipe to confirm Buy Long or Sell Short.

Order placement panel on mobile

Step 5. Position Management Tap the “Positions” tab to see your open positions. Click on a position to set a TP/SL or close it.

List of open positions in the mobile app

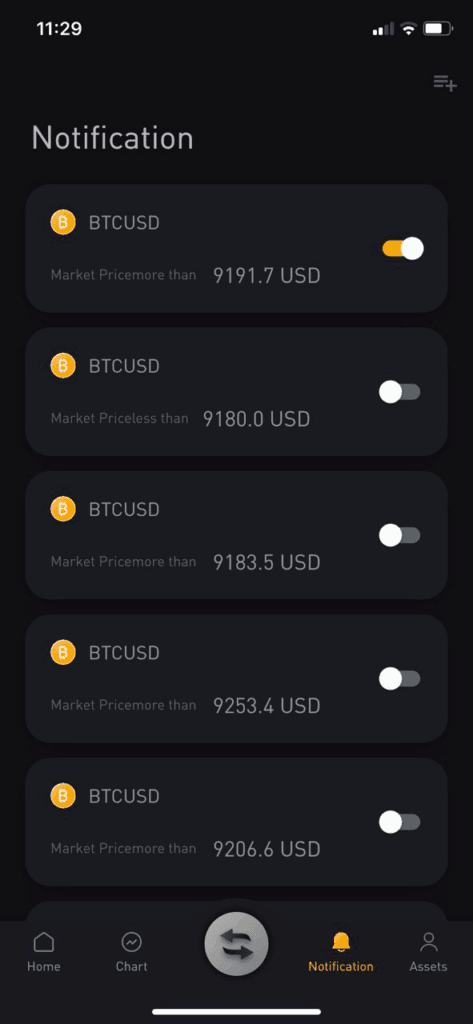

Step 6. Monitoring and Notifications Enable push notifications for important events: TP/SL triggering, approaching liquidation, margin changes.

In-app notification settings.

Calculator and example of position calculation

Bybit provides a built-in calculator for calculating position parameters before entering.

Calculation example:Conditions: $1,000 deposit, BTC trading at $30,000, we want to open a long position with 5x leverage.

Step 1. Determine the position size Risk 2% of the deposit = $20. With 5x leverage, we can control the position up to $5,000.

Step 2. Calculate the stop-loss We want to risk $20 (2% of the deposit). With a position of $5,000, this is a 0.4% price move. Stop-loss at $29,880 (0.4% below the entry of $30,000).

Step 3. Determine the take profit Risk/Reward 1:3. Risk $20, target $60. This is a 1.2% move = $30,360.

Step 4. Checking the Liquidation With 5x leverage and an entry of $30,000, the liquidation is approximately -20% = $24,000. A stop-loss of $29,880 will be triggered much earlier.

Step 5. Consider commissions Entry and exit with a taker commission of 0.055% × 2 = 0.11% of $5,000 = $5.5. Subtract from potential profit.

Total: risk $20, potential profit $60 – $5.5 = $54.5. Risk/Reward ≈ 1:2.7 after commissions.

Critical Risk Alerts

Leveraged cryptocurrency futures trading is one of the riskiest ways to trade financial markets. According to ESMA and the FCA, 74-89% of retail accounts lose money on derivatives. With cryptocurrencies and high leverage, this figure is even higher.

Leverage works both ways. With 10x leverage, you’ll earn 100% on a 10% gain, but you’ll lose everything on a 10% decline. Most newbies liquidate within the first few weeks due to poor risk management.

Crypto market volatility is extreme. Daily movements of 20-30% are normal. One tweet, news item, or technical glitch—and your position is liquidated in minutes, even if the overall forecast is correct.

Invest only money you’re willing to lose. Never invest in loans, borrowed funds, or money for housing, education, or medical treatment. Futures aren’t for savings, only for speculating with available capital.

Don’t chase quick profits. Stories about “turning $100 into $10,000 in a week” are rare exceptions or fiction. The reality: slow capital growth with strict risk management, or rapid loss of money.

Conclusion

Futures trading on Bybit offers powerful tools for making money on cryptocurrencies, but it requires a deep understanding of the mechanics, strict discipline, and sound risk management. Success is only possible with a systematic approach, ongoing learning, and realistic expectations.

The Pocket Option platform offers alternative derivatives with simplified mechanics for those who prefer simpler trading conditions. To gain fundamental knowledge of derivatives, technical analysis, and capital management, explore the educational programs at the Trading Academy, which presents up-to-date methods and strategies for safe trading.