Many people are looking for alternative ways of earning money, seeking to increase their personal capital or create a passive source of income. One of the options is considered to be working with binary options. This field is not like simple fortune-telling: everything here is based on analysis, numbers and competent planning.

The question of how transparent the Pocket Option platform is is often raised. Skeptics claim that the trading service is a hoax, but the facts suggest otherwise. It is enough to pay attention to its functionality, technical support and flexible settings. It is important to remember that trading with options carries risks. However, with a thoughtful approach, the results bring tangible benefits.

Experienced analysts and newcomers from the CIS countries work at the Trading Academy, where there is a community of like-minded people and a lot of high-quality materials on the topic. People compare the Pocket Option approach to analytics with business planning. After all, if someone opens a restaurant or store, they carefully consider investments, make calculations and take into account demand factors. The same logic applies here — without a clear understanding of which indicators to use and which strategy to rely on, it is difficult to achieve stable results.

Features of the Pocket Option platform: what sets it apart from competitors

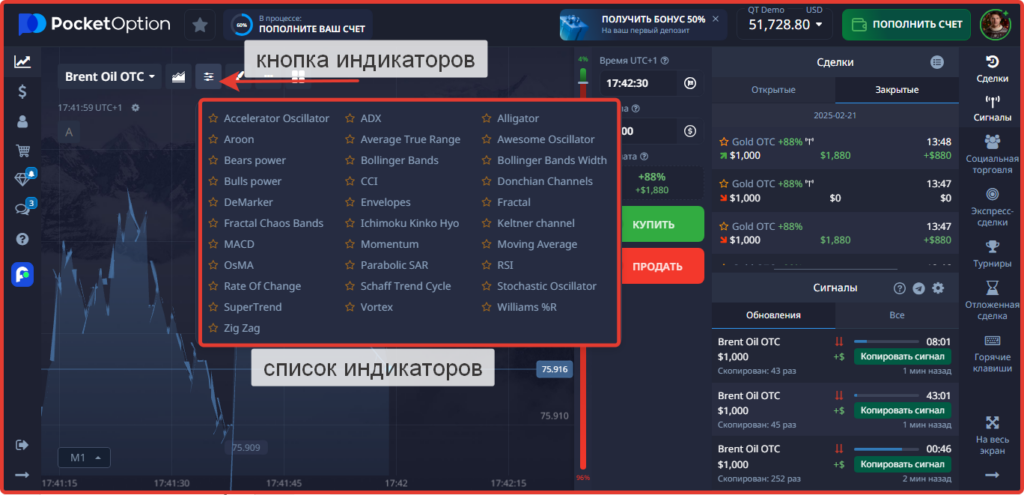

Ease of use is one of the important criteria when choosing a site. The Pocket Option is attractive in several aspects. Firstly, there are many tools for technical analysis. Secondly, a demo environment for training trades is available. Thirdly, the developers have created an intuitive interface. Even in the absence of deep knowledge in the field of trading, the user is not lost. He understands the principle of choosing an asset, and there are ready-made indicator templates. A set of auxiliary functions makes it possible to test different hypotheses.

Doubts about the integrity of the site often arise among those who have encountered questionable brokers. However, Pocket Option works legally, has the appropriate license, and tries to provide transparent conditions for everyone. User reviews indicate simple verification, clear withdrawal rules, and stable terminal operation. This has a positive effect on trust in this site.

To be successful when working with options, you need a well-thought-out strategy. Some rely on intuition, but without a systematic analysis, chaos in decision-making is likely. Indicators allow you to see the real picture of the market, find patterns and respond to trend changes. When compared with entrepreneurial activity, any investment requires detailed calculations. It’s the same here: before opening a deal, you need to assess the risks and possible profits.

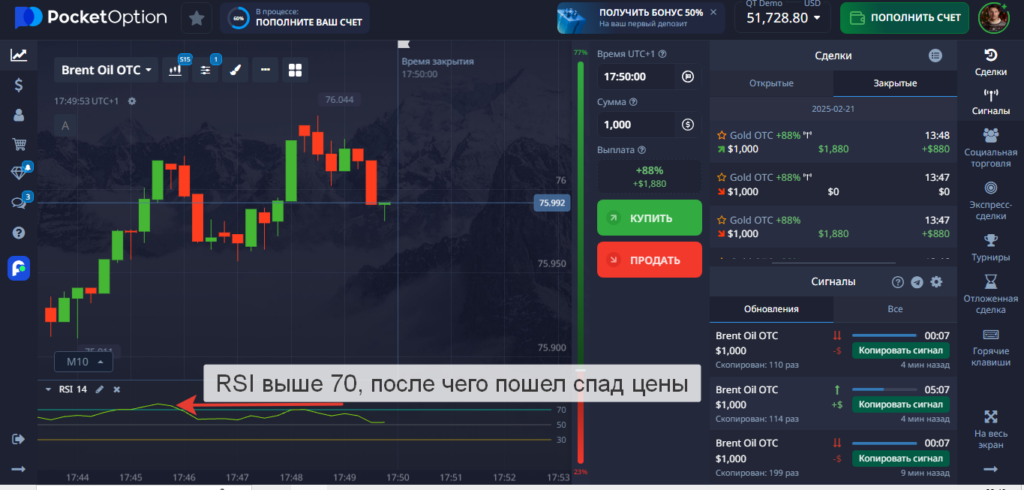

RSI: trend strength indicator

RSI stands for Relative Strength Index. It reflects the relative strength of the asset’s movement and ranges from 0 to 100. High values (from 70 and above) hint at an overbought zone, while low values (below 30) indicate oversold conditions. This allows you to identify potential pivot points.

Experts pay attention to several key RSI signals. First, there are levels 30 and 70. Secondly, they evaluate the divergence — the discrepancy between the direction of the price on the chart and the indicators of the indicator itself. If the price goes up on the chart, and the RSI records a decline, there is a possibility of an early reversal.

Important aspects related to the use of RSI:

- Setting up the period. The Pocket Option usually has a period from 7 to 14.

- Tracking extreme zones. When the RSI exceeds 70, it is not uncommon for a pullback to occur.

- Divergence. The discrepancy between the chart and the indicator is considered a warning of an imminent trend change.

These three points help you find entry points. After finishing working with the RSI, it is logical to confirm the signal with other instruments. By itself, the RSI does not always provide an accurate forecast.

After receiving the basic signal, it is recommended to evaluate the technical picture. You can add, for example, moving averages. Then the probability of error is reduced. It is also important to respond to market volatility. Sometimes the market behaves aggressively, and the RSI goes over 80. In such a situation, it is worthwhile to carefully look at the price behavior in order not to open a deal at the top, where a spurt in the opposite direction is possible.

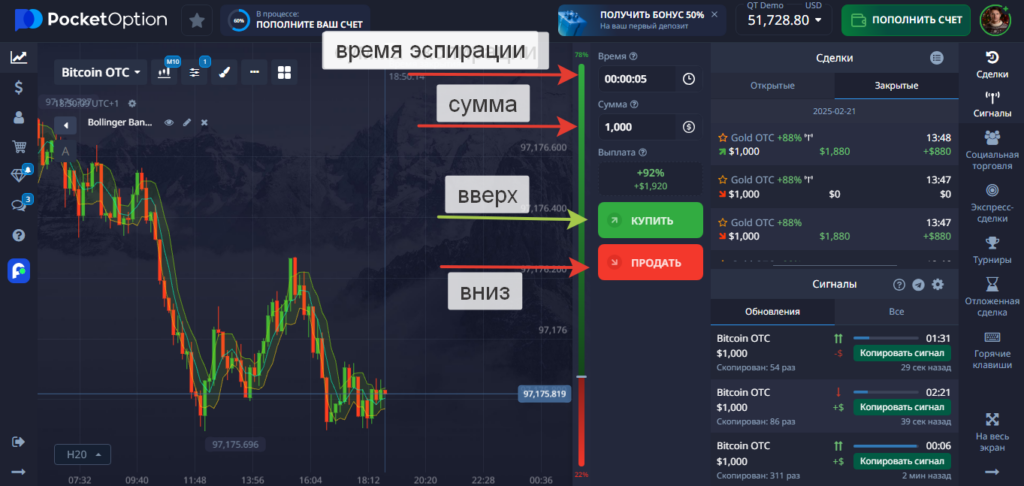

Bollinger Bands: a guide to volatility

Bollinger bands are one of the most well—known tools for analyzing market dynamics. It is based on the calculation of moving averages and shows the boundaries within which the price is moving. The central band is the smoothed average for the selected period. The upper and lower lines are the standard deviations. When the market is calm, the bands narrow. As activity increases, they expand.

Bollinger Bands helps you identify moments of sudden movement or long lull. If the price goes beyond the channel boundary, a correction is often observed. On the Pocket Option, setting up Bollinger bands is easy. It is enough to select a period (20 is often used) and set the number of standard deviations (usually 2). This indicator is suitable for strategies involving breakouts or bounces.

There are several characteristic signals:

- Narrowing of the bands. This situation indicates a decrease in volatility. A surge in activity is likely in the near future.

- Touching the upper band. Sometimes the price turns down. However, if the trend is strong, further upward movement is possible.

- Touching the bottom bar. The situation is similar, but in the opposite direction.

Checking the Bollinger Bands indicators often goes hand in hand with the RSI or Stochastic. This allows you to refine the signals and monitor the moment of potential entry. It is not recommended to focus on just one element. It is important to be careful and distribute the risks.

MACD: a combination of trend and momentum

The MACD (Moving Average Convergence Divergence) is an indicator that combines moving averages and a histogram. It reflects the ratio of the fast-moving and slow moving averages, as well as the difference between them. Many traders find the MACD useful for determining when lines cross and when a trend moves from an uptrend to a downtrend.

The main part of the MACD is the fast and slow lines. A histogram appears between them, showing the difference. When the histogram turns positive, it indicates an increased upward movement. When moving into the negative zone, there is an increase in the downward trend. On Pocket Option, there is a sufficient choice of parameters that are customized to a specific trading style.

Among the key MACD signals are:

- The intersection of the zero line of the histogram. This is often a sign of a change in market sentiment.

- Intersection of fast and slow lines. Top-down or bottom-up transition.

- The divergence between the price chart and the MACD histogram.

These three factors help you make timely decisions. The benefits of the MACD are seen when combined with other trend indicators, such as moving averages. Where the MACD line crosses zero, the price often changes direction. But you need to keep in mind the risks: sharp market fluctuations can give false signals.

Stochastic Oscillator: searching for reversal moments

Stochastic shows where the current price is in relation to the range for the selected period. The scale ranges from 0 to 100. The upper limit (from 80 and above) indicates potential overbought, the lower limit (up to 20) indicates oversold. Stochastic is popular among those who are looking for reversals and short binary options trades.

The special feature of Stochastic is that it reacts quickly to movements. It is suitable for short timeframes. In Pocket Option, it is adjusted for periods K and D (the classic values are 14, 3, 3). It is believed that the intersection of the K and D lines in the zone above 80 often portends a downward pullback, and the intersection in the zone below 20 indicates a possible upward rebound. Although these signals are subject to market noise.

Bollinger Bands and Stochastic are a combination that is often mentioned in reviews. The Bollinger bands indicate an expansion or narrowing of the range, and the Stochastic specifies the moment when the price reaches the limit. For a more reliable estimate, they additionally look at the volumes, if this is available on the platform. Pocket Option offers integrated volume indicators for some assets, which also expands the horizons of analysis.

Moving Average: basic support for analysis

The moving average (MA) is the simplest tool that averages the price over a certain period. It is used to visually assess the overall trend. If the MA line is pointing upwards, the upward movement prevails. When moving downwards, the downward direction prevails. There are several options available on the Pocket Option: SMA (Simple Moving Average), EMA (Exponential Moving Average) and others.

The Ma is found in almost every indicator, as it serves as the basis for calculations. When working with binary options, a trader often combines several moving averages with different periods. When the fast MA crosses the slow one, a buy or sell signal appears. At this point, the price most often confirms a change in market sentiment. It is necessary to take into account the time interval, because signals occur more often on the minute chart, but the risk of false alarms increases.

Let’s list a few important nuances for using the Moving Average.:

- Period. For long-term transactions, choose periods from 50 to 200. For short ones — from 5 to 21.

- The type of sliding line. The EMA reacts faster to fluctuations, while the SMA smooths out fluctuations more strongly.

- Intersections of several moving averages. If lines of different lengths diverge, an early signal is possible.

After the signal from MA appears, confirmations from other indicators are checked. This helps to avoid a situation where the price is adjusted and the moving average does not have time to reflect a short burst of volatility.

Alligator: Bill Williams’ business card

The Alligator consists of three moving averages called “jaw”, “teeth” and “lips”. They have different periods and are offset by a certain number of bars. This indicator was proposed by Bill Williams as a way to filter market noise. It shows the moments when the market is “sleeping” (the lines are intertwined) and when it is “waking up” (the lines are diverging).

On the Pocket Option, the Alligator is available in the Bill Williams indicators section. It’s easy to set periods and set colors there. If the lines diverge and line up in the order blue (jaw), red (teeth), green (lips) from top to bottom, then the trend is considered downward. If the position is reversed, there is an uptrend. Line crossings signal a change of mood.

For binary options trading, Alligator is used in combination with other tools. It is suitable for detecting directional movement. When the “alligator” sleeps for a long time, a strong breakthrough often comes. These points are used for breakout trades. The main thing is to take into account the market situation and the selected timeframe. At the same time, short-term transactions are more risky, especially during periods of unpredictable price movement.

Momentum: estimation of the rate of price change

Momentum evaluates how quickly and strongly the price changes over a selected period. It is a simple line that oscillates around the central level (usually 100). If Momentum is above this mark, then the current price exceeds the previous average for the period. If it’s lower, it’s the opposite.

On the Pocket Option, the Momentum setting requires you to specify a period. The shorter the period, the more sensitive the indicator is to short-term fluctuations. The value 10 or 14 is often used. High Momentum indicators indicate a sharp movement, low indicators indicate a sluggish market. When extreme values are reached, a reversal can be expected, although the accuracy of the forecast increases in combination with additional indicators.

Combining indicators: new horizons on Pocket Option

Many Pocket Option users prefer an integrated approach. It consists in the simultaneous use of several indicators that complement each other. For example, the Bollinger Bands indicates volatility, the RSI shows overbought zones, and the MACD confirms trend dynamics. As a result, the picture becomes more complete.

Combining indicators gives additional signals. One tool reflects the trend, and the other identifies the entry point. Keep in mind that the overabundance of lines and histograms on the chart is disorienting. It is optimal to choose 2-3 tools that do not duplicate the function. Then the signals match less often, but the result turns out to be more accurate.

Below is an example of a set of indicators that allow you to get balanced signals.:

- The RSI is used to identify overbought and oversold areas.

- EMA (9 and 21) for visual assessment of the trend and intersection points.

- MACD with basic settings to confirm a change of direction.

Here, each component is responsible for its own task, and the overall picture gives a signal with a higher level of reliability. When working with a real balance, it is advisable to test such a scheme on a demo account in advance. The Pocket Option has a separate section for this. There, users train in a relaxed environment without risking real money.

The screen simultaneously activates the Bollinger Bands, RSI and MACD, which provides a comprehensive assessment of the situation.

A practical guide: how to benefit using the platform’s tools

Pocket Option provides flexible functionality, and indicators provide objective signals. However, the analysis itself is not useful without a clear plan. It is important to determine the purpose, the size of the transaction and the expiration time. Additionally, the entry levels are being worked out. The approximate procedure is shown below.

- Select an asset. It is recommended to focus on the tool where the price behavior is clear.

- Define a timeframe. For short-term transactions, one-minute or five-minute intervals are suitable. For a more relaxed trading, they take watches or day watches.

- Set up 2-3 indicators. One for trend estimation (MA, Alligator), the second for overbought zones (RSI or Stochastic), the third for confirmation (MACD).

- Evaluate the signals. If the tools point to a single picture, then it’s the right moment to enter.

- Make a deal. At the same time, distribute the risk. Do not use the entire deposit in one operation.

These steps are the basic outline. The task of each trader is to find his own strategy and adjust the parameters of the indicators to his personal preferences. Do not try to catch any microwave. The goal is to work systematically, observing risk management.

Working with binary options involves risk. One unsuccessful transaction can affect the entire deposit if the principles of financial security are violated. Many beginners make the following mistake: they enter the market on emotion or after one or two wins in a row. The lack of a plan inevitably leads to chaotic actions. For this reason, the rule of a fixed percentage of the deposit for each transaction is used.

Among other important aspects:

- The desire to “win back” after a series of losing trades. This leads to a violation of discipline.

- Constantly switching between indicators in the hope of finding a “super signal”. This behavior only leads to confusion.

- Blind copying of other people’s strategies. What worked for one may fail the other.

After a series of failures, it’s useful to take a break. It is important to review the strategy and assess which points were missed. If the work is carried out without proper risk settings, irreversible losses occur. Pocket Option provides a set of tools, but proper handling of them plays a key role.

Real example: how the indicators helped the entrepreneur

Many participants of the Trading Academy tell real cases. One entrepreneur from the field of sports equipment sales decided to diversify his income. He chose the Pocket Option and used a combination of RSI and Bollinger Bands. At the moment when the price of the asset touched the upper band several times, the RSI was above 70. This combination indicated a potential pullback. The entrepreneur opened a short-term reduction deal. The calculation turned out to be correct, and the deal brought in revenue.

Such a story does not exclude mistakes or losses. More importantly, the indicators allowed us to evaluate the market from several sides. If an entrepreneur had focused on one strip of Bollinger Bands, the result might have been different. Whenever it comes to investments, it is better to approach the matter comprehensively.

Table of comparative characteristics: a brief overview of indicators

Below is a summary table with the main properties of the tools discussed. This makes it possible to quickly look at the features of each of them and compare in which cases they are most useful.

| The indicator | Main function | The best timeframe | The main signal |

|---|---|---|---|

| RSI | Overbought/Oversold assessment | Short/Medium | Breakdown of the 30/70 zones, divergence |

| Bollinger Bands | Volatility and movement channels | Average | Touching the upper/lower band |

| MACD | Trend and Momentum analysis | Medium/Long | Intersection of lines, divergence |

| Stochastic | Overbought/oversold | Short | Breakdown of 20/80 levels, K/D intersection |

| Moving Average | General trend | Any | Intersection of fast and slow MA |

| Alligator | Noise filtering, trend | Medium/Long | Divergence of “jaw”, “teeth”, “lips” |

| Momentum | The rate of price change | Short/Medium | Line departure above/below level 100 |

The table contains key criteria such as the timeframe and the main signal. This makes it easier to find the right tool for your strategy.

Conclusion: summary

The Pocket Option platform provides an extensive set of tools, and indicators serve as a kind of compass in the sea of quotes. In the right hands, these tools turn into the key that unlocks the door to financial opportunities. However, it is important to remember that the mere presence of a better indicator does not guarantee instant success. It requires clear discipline, risk control, and an understanding of market cycles.

The Academy of Trading enjoys wide popularity in the CIS market. Its participants share techniques where a combination of several Pocket Option indicators gives accurate signals. This synergy allows us to find interesting entry points and manage resources competently. The main thing is to avoid the illusion of a “magic button”, because binary options require attention to detail.

In the world of real investments, every step is like a long voyage on a ship, where the indicators are beacons. They indicate safe routes, warn about underwater reefs, and help you choose a course. Without these landmarks, you can wander in the dark and lose money, but with them the path becomes brighter and clearer. Pocket Option looks like a reliable vessel, and a competent combination of tools ensures confident movement to the desired shore.