Trading offers opportunities to earn money in financial markets, but it requires serious preparation and discipline. According to experts at the Trading Academy, achieving stable profits takes 6 to 18 months of systematic training and practice. The Pocket Option platform offers a demo account for practicing your skills without the risk of losing real money. In this article, we’ll cover the basics of trading, the necessary knowledge, tools, and strategies for achieving your first significant results.

Trading offers opportunities to earn money in financial markets, but it requires serious preparation and discipline. According to experts at the Trading Academy, achieving stable profits takes 6 to 18 months of systematic training and practice. The Pocket Option platform offers a demo account for practicing your skills without the risk of losing real money. In this article, we’ll cover the basics of trading, the necessary knowledge, tools, and strategies for achieving your first significant results.

What is trading

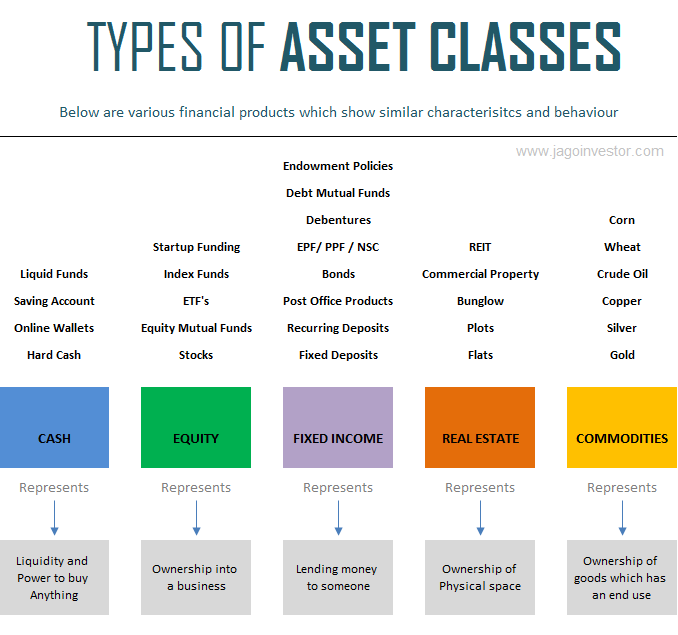

Trading is the buying and selling of financial assets with the aim of profiting from price differences. Unlike long-term investments, traders operate on shorter timeframes: from a few seconds to several weeks. The bulk of their income is generated through repeated trades, each yielding a relatively small profit.

Modern trading is accessible to virtually everyone thanks to online platforms and low entry barriers. You can trade stocks, cryptocurrencies, currency pairs, commodities, and other instruments. The cryptocurrency and forex markets operate 24/7, allowing you to choose a convenient time to trade. Stock markets trade according to exchange schedules.

Major Asset Classes – Infographic

A key feature of trading is active position management. Traders constantly analyze the market, monitor the news, study charts, and make quick decisions. This requires concentration, analytical skills, and emotional stability.

The Difference Between a Trader and an Investor

A trader profits from short-term price fluctuations by opening and closing positions throughout the day, week, or month. Their goal is to catch market movements and lock in profits before the trend reverses. An investor buys assets for years, expecting long-term growth, and doesn’t react to short-term declines.

Main differences:

- A trader works with technical analysis and short-term patterns, while an investor relies on fundamental analysis and long-term prospects.

- A trader spends several hours a day on charts, while an investor checks their portfolio once a week or month.

- The trader takes profits frequently and in small amounts, while the investor expects major growth in a few years.

- A trader can make money on both rising and falling markets, while an investor usually buys in anticipation of growth.

Key terms to know

Without understanding basic terminology, it’s impossible to understand trading. These terms appear in every educational material and on trading platforms.

SL/TP and other chart terms

Key terms:

- Long (long position) – buying an asset in anticipation of a price increase for subsequent sale at a higher price.

- Short (short position) – selling a borrowed asset in anticipation of a price drop for subsequent repurchase at a lower price.

- Stop-loss is an automatic order to close a position when a certain loss level is reached to protect capital.

- Take profit is an automatic order to lock in profits when a target price level is reached.

- Volatility is the degree of variability in the price of an asset; high volatility means sharp movements up and down.

- Liquidity is the ability to quickly buy or sell an asset at a market price without significantly affecting it.

- Leverage—the ability to trade with amounts greater than your own capital—magnifies both profits and losses.

- Bid/Ask and spread — the purchase/sale price of an asset. The spread is formed by the market and liquidity. The exchange commission (maker/taker fee) is charged separately.

A demo account as a useful tool for a beginner

A demo account is a training platform where you can practice strategies without the risk of losing real money. The platform provides virtual capital (usually between $10,000 and $100,000) for trading in real market conditions.

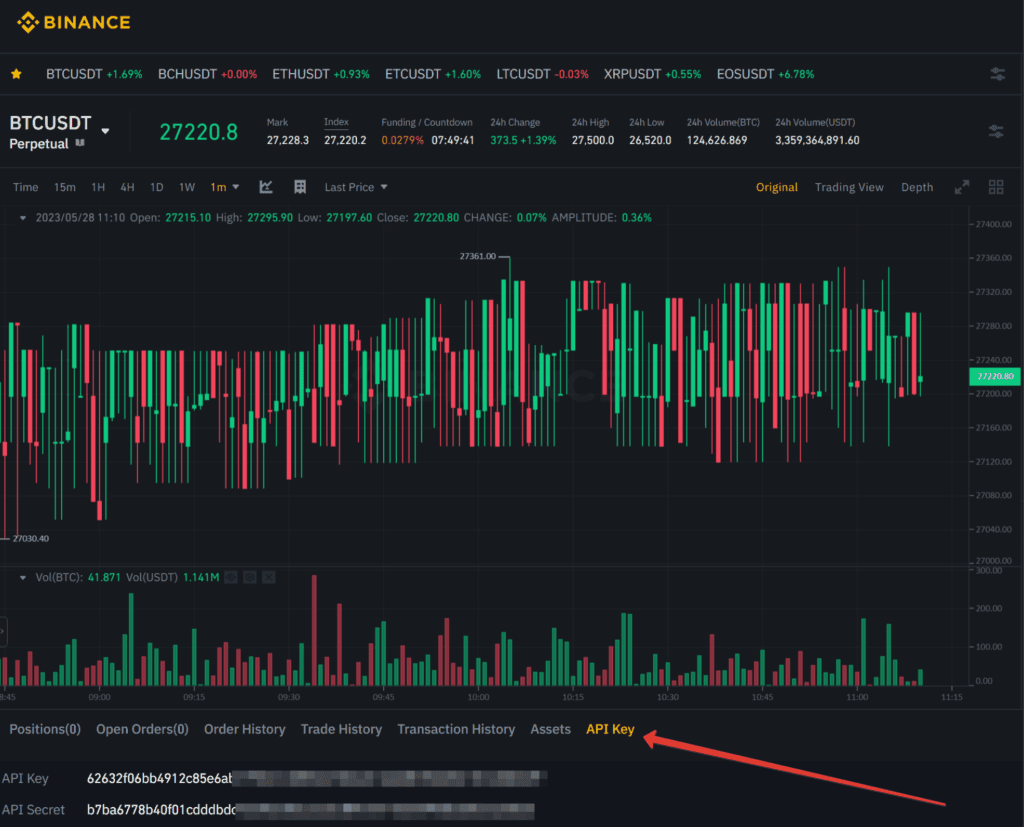

Binance Testnet: Chart and Positions Tab

The main advantage is the ability to make mistakes without financial consequences. You can test strategies, study market reactions to news, learn how to work with indicators, and practice emotional control.

A reasonable approach is to spend at least 2-3 months on a demo account, practice your strategy on at least 100 trades, and demonstrate consistent profitability. A demo account won’t completely replace real trading, but it does provide basic skills and reduce the likelihood of critical mistakes at the start.

What risks should you be prepared for?

Trading involves real financial risks. Understanding these risks helps you protect your capital and avoid total loss.

Main types of risks:

- Market risk—the price moves in the opposite direction from the forecast due to unpredictable events or news.

- Leverage risk – trading with high leverage can result in the liquidation of the entire position in minutes.

- Technical risk – platform failures, internet problems, or delays in order execution lead to unplanned losses.

- Psychological risk—emotional decisions and attempts to recoup losses can ruin even good strategies.

Professional traders follow strict rules: they don’t risk more than 1-2% of their deposit per trade, set mandatory stop-losses, and lock in profits at predetermined levels.

Technical and Fundamental Analysis

Traders use two main approaches to predict price movements.

Technical analysis is based on the study of charts and historical data. Technical analysts use indicators (moving averages, RSI, MACD), support and resistance levels, and chart patterns.

MA, RSI, S/R levels on the chart

Fundamental analysis examines the real value of an asset: for stocks, it examines the company’s financial statements, profits, and debt; for cryptocurrencies, it examines the project’s technology, team, and partnerships. Macroeconomic factors (inflation, central bank rates), industry news, and competitive position are also taken into account.

Short-term traders often rely on technical analysis, while long-term traders rely on fundamental analysis to select assets and technical analysis to determine when to buy.

Types of Trade

Scalping – positions last from a few seconds to minutes, dozens of trades per day. Requires maximum concentration and low commissions.

Day trading – all positions are closed within one day, 4-8 hours in front of the monitors.

Swing trading is trading on medium-term trends lasting from a few days to weeks. Suitable for people with a full-time job.

Positional trading—positions are held for months, ignoring short-term fluctuations.

Swing trading is often recommended for beginners—it doesn’t require constant screen time and gives you time to consider your decisions.

Basic Patterns and Signals

Chart patterns are recurring formations on a chart that indicate future direction of movement.

Styles: scalping/day/swing/positional

Basic patterns:

- Head and shoulders – formed at the top of a trend, signals a downward reversal.

- Double Bottom/Top – Indicates a reversal after testing the same level twice.

- A flag is a short consolidation after a sharp move, usually continuing in the direction of the trend.

- Triangle – narrowing of the range of fluctuations, breakout leads to a strong move.

It’s important to understand that no pattern works with 100% accuracy. Each signal needs to be confirmed by additional factors: volume, indicators, and the overall trend.

Important Services

TradingView (https://ru.tradingview.com/) is the most popular technical analysis platform. It offers advanced charts with hundreds of indicators and a social network for traders. The basic version is free.

CoinMarketCap (https://coinmarketcap.com/) is the leading cryptocurrency data aggregator. Prices, volumes, market cap, historical data, and industry news.

Additionally useful: Coinglass (https://www.coinglass.com/) for futures analytics and market metrics (data is not an exact signal, but only a counter-market metric), CoinGecko, and Glassnode for on-chain analysis. Availability varies by jurisdiction.

Conservative and Aggressive Approaches to Trading

Minimal-risk strategies generate moderate profits while preserving capital. Trend-following trading on long timeframes, using a strict stop-loss of no more than 1-2% of the deposit, avoiding high leverage (maximum 2x), portfolio diversification, and trading only liquid assets.

Aggressive strategies can generate huge profits in a short period of time, but are equally likely to result in a complete loss of the deposit. Trading with high leverage (10x-100x), scalping on the news, risking 5-10% per trade, trading without stop-losses, and trading low-liquidity altcoins. Not recommended for beginners.

What to choose: spot, futures, or binary options?

Spot trading is the typical buying and selling of assets. You own the asset, and the maximum loss is its value. Just to be clear, there’s no risk of liquidation, so you can hold it for years.

Futures are contracts to buy/sell at a fixed price in the future. They allow you to profit from declines (short), using leverage up to 100x, but carry the risk of a complete liquidation of your deposit and a commission for financing the position.

Futures vs Options: Comparison of Parameters

Binary options are bets on the direction of price movement over a period. You predict up or down, and if your prediction is correct, you receive a fixed profit (60-90%); if your prediction is incorrect, you lose the entire bet. The fixed risk and profit are known in advance, the timeframes are short, but early exit is impossible.

Important: Binary options are prohibited by ESMA and FCA regulators in many jurisdictions due to the high risks involved. Check the legality in your country. This instrument requires highly accurate forecasts and carries the risk of rapid capital loss.

Beginners are recommended to start with spot. After gaining experience, you can move on to futures with minimal leverage.

Pocket Option Features for Traders

The Pocket Option platform offers tools for binary options trading. A demo account with a $10,000 virtual balance allows for risk-free practice, fixed risk per trade, and trading on over 100 assets. Minimum deposit: $50.Please note: Availability may vary depending on regulatory restrictions in your country. Always verify the legality of binary options trading in your jurisdiction before proceeding.

Psychology and Qualities of a Trader

Most beginners think that success depends on knowing indicators. In reality, psychology plays a more important role. Even the perfect strategy won’t work without emotional control.

Psychological traps:

- FOMO—the fear of missing out on profits—causes people to enter trades at peaks without analysis.

- Trading after losses—attempts to recoup losses lead to rash decisions.

- Averaging losses is adding funds to a losing position in hopes of a reversal.

- Overconfidence – after a series of profits, risk increases and rules are ignored.

- The return-to-entry-point effect is the desire to close a losing position at breakeven instead of a stop-loss.

The Psychology of Market Cycles – Infographic

Key qualities of a trader:

- Discipline is following a plan and risk management rules even when emotions dictate otherwise.

- Patience is the ability to wait for quality opportunities and not trade for the sake of the process.

- Stress tolerance—clarity of thought during times of loss and pressure.

- Teachability is the willingness to admit mistakes and change your approach.

- Realism—understanding the risks and lacking illusions about quick enrichment.

Which exchanges are worth trading

Binance is the largest exchange by volume, with hundreds of trading pairs, low fees, and high liquidity.

Bybit — specializes in futures, intuitive interface (Lite mode for beginners and Pro mode for experienced traders).

OKX — powerful analytics, wide selection of tools.

When choosing, check licenses, read reviews, evaluate trading volumes, and consider KYC requirements. Use two-factor authentication, and avoid keeping large amounts of money on the exchange permanently.

What capital should I start with?

For spot trading, a reasonable minimum is $500-$1,000. This amount allows you to apply the 1-2% risk per trade rule and diversify your portfolio. For futures, you can start with $200-$500, but only with a minimum leverage of 2x-3x and after gaining experience on a demo account.

With $50-100, it’s better to use a demo account or platforms with minimum stakes to gain experience.

The main rule: Trade only with available funds, the loss of which will not affect your financial situation. Never use loans or funds for important purposes.

Common Mistakes Newbies Make

Typical mistakes:

- No trading plan – random, emotion-driven trades without a strategy.

- Ignoring stop-loss orders—hoping to reverse a losing position—leads to disaster.

- Trading large positions—risking 20-50% of your deposit—guarantees a quick loss.

- FOMO and market chasing – entering after the move has already happened.

- Overtrading—dozens of trades a day without quality setups.

- Underestimating commissions – Frequent trading with small capital makes profit impossible.

FOMO Trading: How to Avoid It

Trading on emotions after losses is especially dangerous. After a series of losing trades, the right decision is to stop, analyze your mistakes, and return with a cool head.

To summarize: what you need to do for success

Trader’s Roadmap:

- Theory (2-3 months) – study of terms, types of analysis, risk management, psychology.

- Demo account (3-4 months) — trading with virtual money, 100+ trades.

- One strategy is to practice on a demo until stable profitability is achieved for 2-3 months in a row.

- Statistics – keeping a trading diary, analyzing each transaction.

- Small real – start with $200-500, use the same rules as on the demo.

- Scaling is the gradual increase of capital from profits, rather than new investments.

Experts at the Trading Academy emphasize the importance of a systematic approach. The goal of the first year is to preserve the deposit and develop sustainable skills.

Critical Trading Risk Warnings

Trading in financial markets carries a high level of risk and can result in the complete loss of your investment. Statistics show that over 75-85% of new traders lose their deposits within the first year.

Financial risks include unpredictable volatility, technical exchange failures, hacker attacks, and sudden movements due to news. Even professionals regularly experience capital drawdowns. Past success does not guarantee future profits.

Psychological risks are especially dangerous for beginners. Excitement, the desire to get rich quick, and attempts to recoup losses lead to rash decisions. Emotional trading is the main cause of losses.

Leverage risks magnify losses many times over. 10x leverage means a 10% move against the position will result in complete liquidation. Beginners are strongly advised against leverage greater than 2x-3x.

Regulatory risks arise from differences in legislation. In some jurisdictions, trading cryptocurrencies or binary options is restricted or prohibited. Ensure that trading is permitted in your country.Invest only funds you can afford to lose completely. Never use borrowed money, loans, or funds for critical purposes.

Don’t view trading as a get-rich-quick scheme. It’s a professional activity that requires years of training. Any promises of a guaranteed income are signs of a scam.

Conclusion

The path to trading success requires a comprehensive approach: deep analytical knowledge, proven strategies, strict risk management discipline, and constant work on your psychology. The first $100,000 in profit is the result of several years of systematic training, practice on a demo account, and careful capital accumulation.

The Pocket Option platform provides fixed-risk trading tools and a demo account for safe practice. To gain fundamental knowledge of financial market principles, strategies, and risk management, we recommend studying the educational programs at the Trading Academy, which presents up-to-date methods and proven approaches to capital protection.