Traders using Pocket Option for working with volatile assets, they know that it is important to understand the project before the HYPE subsides. Materials Trading academies help to understand the fundamental factors influencing the price of such assets.

What is Plasma (XPL)?

Plasma is positioned as a first-level blockchain (Layer 1), optimized for working with stablecoins. The main difference from Ethereum or Solana is its narrow specialization. Instead of trying to service the full range of crypto assets, the team focused on digital dollar transfers.

The key feature of the network is the lack of fees for basic USDT transfers. The protocol uses the built-in paymaster mechanism, which covers gas for simple transactions. At the same time, smart contracts, DeFi operations, and other complex interactions require payment in XPL tokens.

On September 25, 2025, the main network was launched in beta mode. According to CoinMarketCap, at the time of writing, XPL ranks 51st in terms of capitalization with an indicator of about $1.5-1.6 billion. Daily trading volumes range from $2-2.3 billion, which indicates high liquidity for a young asset.

Who created the project

Plasma’s founder and CEO is Paul Faecks, a graduate of the Technical University of Munich. Before Plasma, he worked at Deribit and founded the Alloy company. The team consists of specialists with experience in large technology and financial corporations.

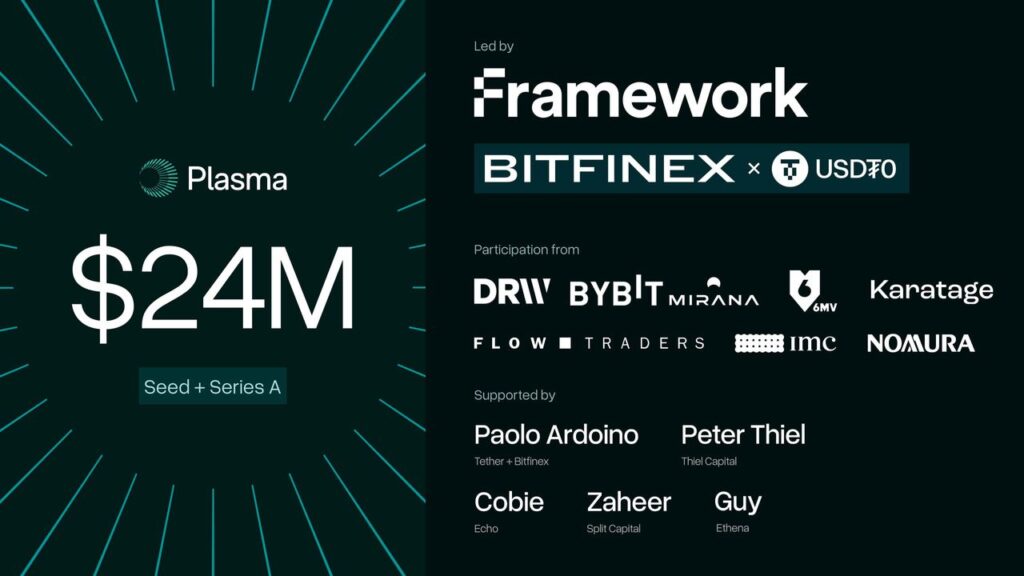

In February 2025, the project raised $24 million from Framework Ventures. Among the participants of the round and advisers are Paolo Ardoino (CEO of Tether), Peter Thiel (co—founder of PayPal), representatives of Bitfinex. In May, another round followed with the participation of the Founders Fund for $20.5 million at a valuation of $500 million.

In an interview with Fortune, Fex explained the motivation: stablecoins have shown the greatest practical application among all crypto assets, but existing blockchains are poorly adapted to their specifics. High fees and the need to hold native tokens for gas scare off ordinary users.

Tokenomics and metrics of the offer

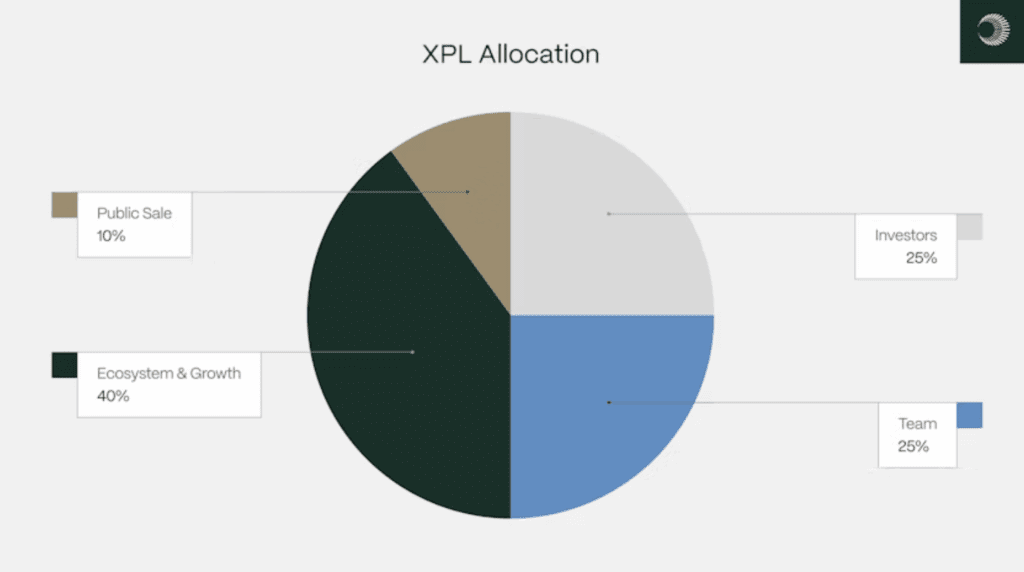

The maximum XPL issue is limited to 10 billion tokens with the following distribution:

- 10% (1 billion) — public sale at $0.05 per token.

- 40% (4 billion) is an ecosystem development fund with a phased unblocking.

- 25% (2,5 млрд) — команда проекта с клифом 1 год и вестингом на 3 года.

- 25% (2.5 billion) are investors with similar unblocking conditions.

There are 1.8 billion XPL in circulation (18% of the total supply). American ICO participants faced an additional restriction — their tokens are blocked until July 28, 2026 due to regulatory requirements.

The inflationary model provides for remuneration for validators: starting from 5% per annum, followed by a decrease of 0.5% annually to a minimum of 3%. At the same time, a “soft slashing” system is used — unscrupulous validators lose only awards, but not the main steak.

How Plasma works

The network architecture is based on three technological solutions:

- PlasmaBFT consensus. Modification of the Fast HotStuff algorithm, providing Byzantine Fault Tolerance. The system continues to work even if up to a third of the validators behave incorrectly or are unavailable. Under normal conditions, two rounds of confirmations are enough to finalize the block instead of the standard three.

- Compatible with EVM. Plasma uses a Rust—based Reth execution engine that is fully compatible with the Ethereum Virtual Machine. Developers can deploy existing Solidity smart contracts without modifying the code. This simplifies the migration of DeFi protocols.

- Integration with Bitcoin. The network periodically writes cryptographic checkpoints to the Bitcoin blockchain, using it as the final layer of security. A trust-minimized bridge is also being developed to transfer BTC to the Plasma ecosystem in the form of wrapped tokens.

Additional features include the ability to pay fees in USDT or BTC (with automatic conversion to XPL) and planned confidential transactions. The latter are in the research stage, no specific implementation dates have been announced.

The value and innovativeness of the coin

XPL performs several functions in the ecosystem:

- Ensuring network security. Validators block XPL as collateral. The more tokens there are in staking, the higher the cost of attacking the network.

- Payment of transactions. Although simple USDT transfers are free, all other transactions require XPL for gas. With the growing number of DeFi protocols and dApps, the demand for the token should increase.

- Protocol management. XPL holders participate in voting on changes to network parameters, although the specific governance mechanism has not yet been launched.

As of early October 2025, the ecosystem is actively developing. Aave, Ethena, and Maple Finance have already announced integrations. The stated total blocked value (TVL) ranges from $4 to $7 billion according to various estimates — the exact data requires additional verification, as the network has been operating for less than a week.

Separately, it is worth noting the launch of the Trillions memcoin on Plasma — the project gained a capitalization of $ 60 million in a day. This shows that despite the focus on stablecoins, the network also attracts speculative capital.

Technical analysis

For a token with a trading history of less than a week, a full-fledged technical analysis is premature. Nevertheless, several observations can be noted:

After reaching the peak values of $1.54-1.59 (data varies depending on the exchange), the price rolled back to the range of $1.10-1.20. A consolidation zone has formed here, which can act as support.

Daily volumes remain consistently high — more than $2 billion. This indicates continued interest from traders and market makers. At the same time, most of the volume is accounted for by the XPL/USDT pair on Binance.

Volatility remains elevated, with intraday fluctuations reaching 15-20%. This creates opportunities for short-term traders, but requires strict risk management.

Forecast for 2026

Predicting the price for such a young asset is a thankless task. However, there are several scenarios that can be considered:

An optimistic scenario. Delphi Digital suggests in its research that if Plasma captures 10% of the USDT transfer market, the project’s capitalization could reach $10 billion. With a fully unblocked offer, this corresponds to a price of about $1 per token. Given that there will be fewer tokens in circulation, the actual price may be higher, in the range of $2-2.50.

Basic scenario. Moderate ecosystem growth, stable transfer volumes, gradual integration of new protocols. The price is in the range of $1.00-1.50 with periodic bursts of volatility.

A pessimistic scenario.Unlocking the tokens of the team and investors in July 2026 will create an oversupply. Historical examples (Avalanche, Unlock Protocol) show the possibility of a 20-40% correction after major unlocks. The price may drop to $0.75-0.90.

Forecast for 2030

Long-term estimates are even more speculative. Different predictive models give a wide range:

Aggressive assessments. (CoinEdition, individual analysts) suggest the possibility of growth to $12-24 in the event of mass adoption of Plasma as the main network for stablecoin transfers. Such forecasts are based on the assumption that the stablecoin market will grow to several trillion dollars.

Moderate forecasts. (Bitget, Bitrue) see a target range of $4-7. This implies Plasma’s capture of 3-5% of the global stablecoin transaction market.

A conservative view. Takes into account the increased competition from Ethereum L2, the development of CBDC and possible regulatory restrictions. In such a scenario, XPL can trade in the range of $2-3.

It is important to understand that all these estimates are based on mathematical models and assumptions about market development. The reality may be completely different.

Where to buy XPL

The token is available on the following centralized exchanges:

- Binance — the main trading pairs with USDT, USDC, BNB, FDUSD.

- OKX — pairs with USDT and USDC.

- KuCoin — base pairs plus margin trading.

- Gate.io — spot and futures trading.

- MEXC — a wide range of trading pairs.

- Crypto.com — also provides custody services for institutional clients.

Binance conducted the HODLer Airdrops program — users who held BNB in Simple Earn products from September 10 to September 13 received part of the 75 million XPL (0.75% of the total issue).

Investment risks

Any investment in crypto assets carries risks, but they are especially significant for XPL:

- Unblocking schedule. After July 2026, the tokens of the team and investors will begin to enter the market — 50% of the total issue. Even if only a part of the holders will sell, this will create pressure on the price.

- Technical immaturity. The network is running in beta mode. Bugs, scaling issues, and vulnerabilities in smart contracts are possible. The team is openly talking about the phased implementation of the functionality.

- Regulatory issues. Restrictions on American investors have already set a precedent. Further tightening of regulation of stablecoins may also affect Plasma.

- Dependence on Tether. If Tether Limited stops supporting the network or runs into its own problems, it will deal a serious blow to the Plasma ecosystem.

- Competition. Tron dominates the Asian segment of USDT transfers. Ethereum L2 solutions (Arbitrum, Optimism, Base) are becoming cheaper and faster. New projects like Sei and Aptos are also aimed at the payments market.

Conclusion

Plasma started at an interesting time. On the one hand, the stablecoin market is growing, and the demand for cheap transfers is obvious. On the other hand, competition is high, and the regulatory environment is becoming tougher.

The project has strengths: a working product, serious investors, and a clear economic model. Free USDT transfers are a real advantage for certain segments of users. But whether this is enough for long—term success, time will tell.

For traders who practice on Pocket Option, XPL volatility creates trading opportunities. At the same time, it is important to keep in mind the risks and not invest funds that you cannot afford to lose.

The materials Trading Academies — there are sections for both beginners and experienced market participants.

This material has been prepared solely for informational purposes and is not an investment recommendation. Cryptocurrencies are high—risk assets. Conduct your own research (DYOR) and consult with experts before making financial decisions.