The cryptocurrency market moves in cycles, and alt season is one of the most profitable periods for traders prepared for rapid movements. Analysts at Trading Academy note that proper preparation for alt season can yield profits tens of times greater than Bitcoin’s growth. In this article, we’ll explore the signs of the approaching alt season, historical patterns, and strategies for preparing for this event.

What is an altseason?

Alt-season is a period in the cryptocurrency market when alternative cryptocurrencies (all coins except Bitcoin) grow significantly faster and stronger than BTC. During these periods, money flows en masse from Bitcoin to altcoins, leading to explosive growth of 100-500% in a few weeks.

Alt season typically begins after Bitcoin has completed its rally and enters a sideways trend. One popular indicator is Bitcoin dominance. A decline in BTC’s share of the total crypto market capitalization and/or prolonged BTC consolidation often coincide with a shift into altcoins; specific thresholds depend on the cycle. Another indirect indicator is that most altcoins in the top 50 show growth above 10% in a week while Bitcoin is trading in a range.

History of previous seasons

The 2017-2018 alt-season was the first major one. Bitcoin rose from $1,000 to $20,000, after which a correction began. In December 2017 – January 2018, altcoins exploded: Ethereum rose from $300 to $1,400, Ripple from $0.20 to $3.40, Cardano from $0.02 to $1.20. Many little-known projects showed growth of 10-50 times in a month. The alt-season lasted about 6-8 weeks, after which a prolonged bear market began.

Comparison of three alt-seasons

The 2021 alt season was more structured. Bitcoin reached $64,000 in April 2021, after which a correction began. May-July saw the first wave of the alt season, with growth in DeFi and NFT projects. The second, more powerful wave occurred in October-November 2021. Ethereum rose to $4,800, Solana from $30 to $260, and Avalanche from $12 to $147. This alt season was more selective—projects with real products and activity grew, not just speculative tokens.

A common feature of all altseasons is that they typically follow Bitcoin’s rally and often precede the onset of a bear market. An altseason typically lasts 4-12 weeks, followed by a correction or a transition to sideways movement for months.

Factors influencing the altseason

Key triggers for the start of the alt season:

- Bitcoin Consolidation – When BTC enters a sideways movement, traders look for alternatives with greater potential.

- Market metrics—a decline in BTC dominance, a 100-200% increase in altcoin trading volumes relative to averages—show activity.

- The influx of liquidity is new money from retail investors looking for entry points into promising assets.

- Positive news—network updates, major partnerships, and exchange listings—are catalyzing interest in projects.

- Activity in new narratives – new trends (NFTs in 2021, RWA/AI in 2024-2025) draw attention to connected tokens.

Factors that could delay or cancel the altseason:

- Macroeconomic problems: the tightening of the Federal Reserve’s monetary policy, recession, and geopolitical crises are reducing risk appetite. Regulatory pressure on the crypto market: bans, SEC investigations, and exchange restrictions are forcing investors to invest in stablecoins.

- Technical problems in major blockchains: hacks, network failures, vulnerabilities create panic and capital outflow.

- Bitcoin’s Rise Continues: If BTC continues to set new highs, capital could remain in it longer than usual.

Useful services for tracking the altseason level

Blockchain Center Altcoin Season Index (https://www.blockchaincenter.net/en/altcoin-season-index/) is a popular altcoin season indicator. It shows what percentage of the top 50 altcoins have outperformed Bitcoin over the past 90 days. A value above 75 is often interpreted as altcoin season, while a value below 25 indicates Bitcoin season. The index is updated daily and provides a visual snapshot of the market’s state.

CoinMarketCap Bitcoin Dominance Chart (https://coinmarketcap.com/charts/) — a real-time chart of BTC dominance. When dominance declines, it may indicate a capital reallocation. The chart shows historical data for comparison with previous cycles.

TradingView Altcoin Season Watchlist – You can create your own list of 20-30 altcoins and track their overall performance. If 70-80% of the list is in the green for several days in a row, the alt season may be gaining momentum.

CoinGecko Total Altcoin Market Cap — a chart of the total market capitalization of all altcoins (excluding Bitcoin). A sharp increase of 20-30% in 1-2 weeks while Bitcoin is stagnating is an indirect sign of activity.

These tools help you rely on data instead of guesswork. When multiple indicators simultaneously show a similar picture, the likelihood of a trend continuation is higher.

Where to trade

Trading altcoins requires exchanges with a wide selection of trading pairs, high liquidity, and low fees. During the altcoin season, volumes increase exponentially, and it’s important for the platform to handle the load.

Recommended exchanges for the alt season:

- Binance — over 600 trading pairs, deep liquidity, spot and futures trading of altcoins. Low fees of 0.1% or less with BNB.

- Bybit offers a good selection of altcoin derivatives, leverage up to 50x, and a well-developed risk management system.

- OKX — a wide selection of altcoins, including new projects, high-quality analytics and indicators.

- Gate.io — specializes in listing new altcoins before others, perfect for finding early opportunities.

It’s wise to have accounts on multiple exchanges, as some promising altcoins are only listed on one or two platforms. Diversifying your exchanges also reduces the risk of technical issues or withdrawal restrictions during peak trading periods.

Before trading, check deposit and withdrawal limits, complete KYC verification in advance, and set up 2FA. During the alt season, exchange support is overloaded, and it may take days to resolve issues.

How to Prepare for the Alt Season

Preparation begins 1-3 months before the expected start of the altseason. By the time the signs become apparent, it’s often too late to get started—most of the movement occurs in the first 2-3 weeks.

Preparation plan:

- Study the top 50 altcoins – analyze projects with a real product, an active community, and regular updates. Eliminate dead projects.

- Create a watchlist of 10-15 alts – choose coins from different sectors (Layer 1, DeFi, AI, Gaming, RWA) to diversify risks.

- Identify entry points – set alerts at key support levels for a smooth entry without FOMO.

- Prepare your capital—allocate 20-40% of your portfolio to altcoins, with the rest in Bitcoin and stablecoins for insurance.

- Set stop-losses and target levels—determine in advance the levels at which you will close 25%, 50%, and 75% of your position.

- Test the exchanges—make trial trades, check the order execution speed, and explore the interface.

A typical mistake is to invest your entire capital in 2-3 altcoins in hopes of maximizing profits. This creates a huge risk: if your chosen coins don’t perform well, you’ll miss out on the alt season. Diversifying across 8-12 projects reduces risk and increases the chance of catching several strong moves.

Forecasts and Probabilities

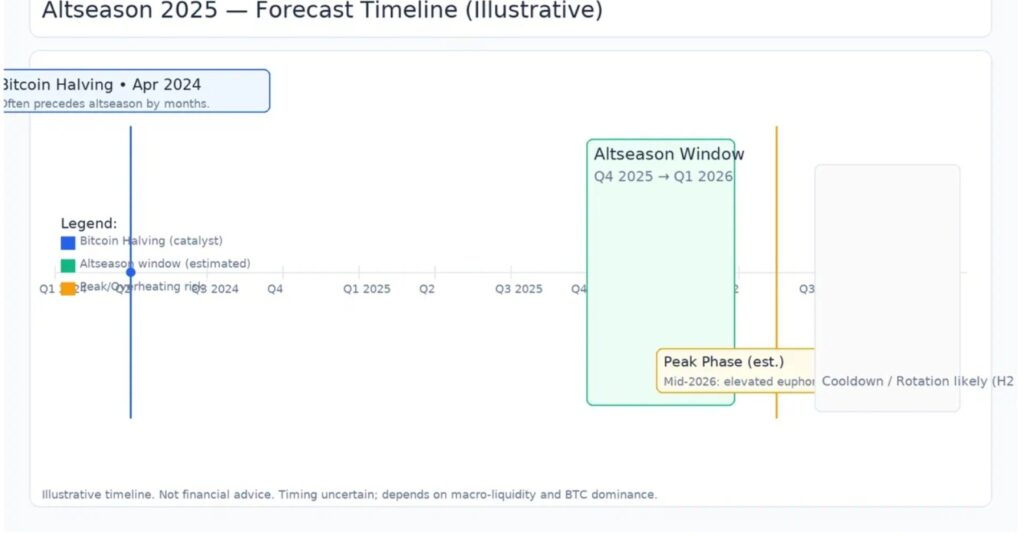

Historically, altseasons have begun 6-12 months after the Bitcoin halving. The 2024 halving creates a window for an altseason in late 2025 to the first half of 2026.

High season forecast 2025-2026

According to analysts at Trading Academy, the likelihood of a full-fledged altcoin season in the first half of 2025 is around 60-70%. The main factors in favor of this are: Bitcoin consolidation at $60,000-$70,000, the launch/expansion of a spot ETH ETF lineup, an influx of institutional liquidity, and growing interest in altcoins with real products.

The alt season scenario can develop in waves: the first wave encompasses large altcoins (ETH, SOL, ADA), the second, mid-sized projects from the top 50, and the third, smaller, low-cap coins. Each wave lasts 2-4 weeks, with corrections in between.

An alternative scenario is a prolonged sideways market without a pronounced altseason if the macroeconomic situation remains unfavorable. In this case, growth will be selective: only projects with strong fundamentals will show significant growth.

Seasonality: September has historically been a weak month for cryptocurrencies, but this isn’t a hard and fast rule. Focus on BTC dominance and trading volumes, not the calendar.

Pocket Option as a means to skim the cream of the upcoming season

The Pocket Option platform allows you to trade short-term altcoin movements without having to buy and hold the coins themselves. During the alt season, volatility peaks—altcoins can rise or fall by 10-20% in a day.

Binary options allow you to profit from these movements with a fixed risk. You predict the direction of an altcoin’s price movement over a short period (5 minutes to 1 hour) and receive a fixed profit of 70-85% if your forecast is correct. If your forecast is incorrect, you only lose the amount you bet.

Advantages: no need to hold volatile altcoins in your portfolio with the risk of a sharp correction; you can profit from both growth and decline; fixed risk helps control losses. A demo account allows you to practice trading strategies for volatile assets without real losses.

Bear Market Likely by Late 2025

A bear market typically follows the peak of the altcoin season. Historical patterns show that after altcoin surges, a prolonged correction of 70-90% from the peak begins.

If the altseason occurs in Q4 2025, the likelihood of a bear market transitioning in the first half of 2026 is significant. Triggers could include profit-taking by major players, macroeconomic issues, regulatory pressure, or the natural depletion of liquidity after the rally.

Signs of an approaching bear market: a sharp decline in trading volumes, growing dominance of Bitcoin and stablecoins, mass liquidations in futures, and negative news beginning to influence prices more than positive news. When altcoins stop rising on good news, it’s a sign of depleted demand.

Protection strategy: Gradually lock in profits as your portfolio grows, avoid holding all your capital in altcoins during peak euphoria, and transfer 50-70% of your profits to stablecoins or Bitcoin for reinvestment during a bear market.

Which coins have potential for the upcoming alt season

Promising categories and examples:

- Layer 1 blockchains — Ethereum (ETH), Solana (SOL), Avalanche (AVAX), Polkadot (DOT). These are foundational infrastructure projects with real-world use cases, a developed ecosystem, and regular updates.

- Layer 2 solutions—Arbitrum (ARB), Optimism (OP), Polygon (MATIC). Scaling Ethereum is critical, and these projects will be the first to benefit from increased activity.

- DeFi protocols — Aave (AAVE), Uniswap (UNI), Curve (CRV). Mature projects with real yields, high liquidity, and active usage.

- AI and Computing — Render (RNDR), Fetch.ai (FET), SingularityNET (AGIX). The trend toward artificial intelligence could attract capital to these tokens.

- RWA (Real World Assets) are real-world asset tokenization projects, a new direction with institutional interest.

Selection criteria: project over 2 years old, market cap from $500 million, active development (commits on GitHub), real-world usage (TVL, active addresses), listing on top exchanges.

Avoid new projects without a product, memecoins without utility (unless you’re planning pure speculation), and tokens with questionable teams or centralized governance.

Which coins are not worth investing in

High-risk categories:

- Memcoins without a product can yield 10-100x returns, but the probability of total capital loss is 90%. Suitable only for speculation with 1-5% of a portfolio.

- Inactive projects—if GitHub hasn’t been updated in months, the community is dead, and the team isn’t communicating—the project is dying.

- Highly Inflated Tokens – The daily issuance of millions of new tokens creates constant selling pressure.

- Projects with legal issues—SEC investigations, lawsuits, and regulatory issues—make investments extremely risky.

- Forks and copies of well-known projects usually lack competitive advantages and quickly lose attention.

- Low-liquidity tokens—daily trading volumes of less than $1 million create the risk of being unable to exit the position at a reasonable price.

Even during the alt season, not all altcoins rise. Many projects remain stagnant or even decline, while market leaders show gains of 100-300%. Focusing on high-quality projects with fundamentals offers a better chance of success.

Conservative Coins

These altcoins are less volatile and considered relatively safe for long-term holding. They are less affected by the alt-season, but they show stable growth and are less susceptible to sharp corrections.

Stable alts for conservative investors:

- Ethereum (ETH) is the second-largest cryptocurrency by market cap and the basis for most DeFi and NFT projects. It grows by 50-150% during the alt season, compared to 300-500% for smaller altcoins.

- BNB (Binance Coin) is the token of a major exchange, with stable usage and regular supply burns. Growth is moderate but predictable.

- Chainlink (LINK) is critical infrastructure for oracles, used by thousands of projects. Demand is stable regardless of the altseason.

- Polygon (MATIC) — Ethereum scaling, partnerships with major companies, real-world use in payments and NFTs.

Conservative strategy: 50% of the portfolio in Bitcoin, 30% in the top 5 altcoins (ETH, BNB, LINK), 20% in riskier projects from the top 50. This provides exposure to the altcoin season with limited risk of total capital loss.

Trading Risk Warnings

Trading altcoins carries an extremely high level of risk and can result in the complete loss of your investment. Altcoins are significantly more volatile than Bitcoin—daily fluctuations of 20-40% are not uncommon. Statistics show that over 90% of altcoins lose 90-99% of their value from their peak during bear markets.

Risks of the alt season include: a sharp correction after the initial rally, when altcoins fall by 30-50% in a few days; market manipulation by large holders (pump and dump schemes); technical problems with projects, hacks, and smart contract exploits; regulatory bans and delistings from major exchanges; complete project collapse and loss of all investments.

Psychological risks are critical during the alt season. FOMO forces you to buy at peaks after a 200-300% rise, greed prevents you from taking profits in a timely manner, and panic during corrections leads to selling at a loss. Most traders enter the alt season too late and exit with losses after a correction.

Invest only funds you can afford to lose. Altcoins are only suitable for experienced traders who understand the risks and have a profit-taking strategy. Never use leverage or leverage greater than 2x when trading altcoins. Don’t invest your entire capital in just one or two coins—diversification is critical.

Any predictions of altcoin growth of 100x or 1000x, or guarantees of an altseason, are signs of fraud. Past altseasons do not guarantee their repetition. The market may enter a prolonged sideways trend or bearish trend without a clear altseason.

Conclusion

Alt-season offers tremendous profit opportunities, but requires careful preparation, discipline, and risk management. Historical patterns show that alt-seasons often follow Bitcoin’s rise and can precede bear markets, but their exact timing is impossible to predict.

A successful strategy includes diversification across high-quality projects, gradual entry using averaging, mandatory profit-taking as the market grows, and strict stop-losses. Using analytical tools helps determine market trends based on data, not emotion.

The Pocket Option platform offers tools for trading cryptocurrency volatility with a fixed risk and the ability to practice on a demo account. For an in-depth study of altseason trading strategies and risk management, we recommend training at the Trading Academy, which presents up-to-date techniques for working with highly volatile assets and protecting capital during periods of market euphoria.