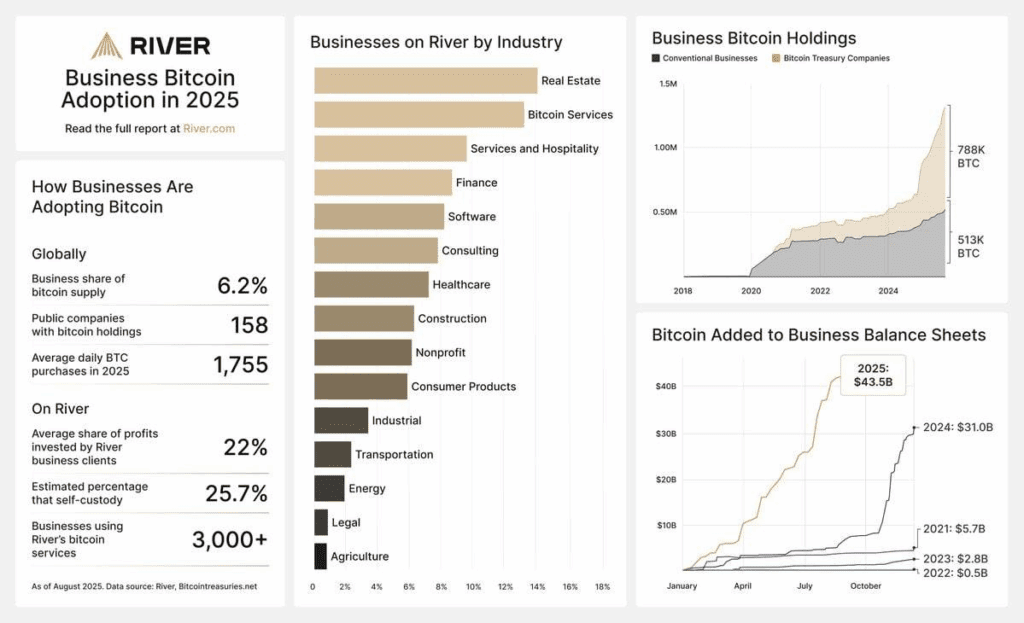

New data shows that private companies continue to actively use bitcoin as a strategic asset. On average, they reinvest about 22% of their profits in BTC, which indicates a growing confidence in the first cryptocurrency as a tool for saving capital and long-term investment.

This trend reflects the changing attitude of businesses towards digital assets: if bitcoin was previously considered as a speculative instrument, today it is gradually becoming part of the corporate financial strategy. For many companies, this is a way to hedge the risks associated with inflation and instability of traditional currencies.

Companies from the technology sector and fintech are particularly active in this area, for which digital assets fit seamlessly into the business model. Analysts note that the growing interest in BTC among private businesses may accelerate the institutionalization of the crypto market and encourage new companies to make similar decisions.

Thus, bitcoin secures its status not only as an alternative asset, but also as a tool to strengthen the financial stability of companies in the long term.