Sources close to the situation claim that there was an oral and private agreement between the Trumps and Sun. It consisted in the fact that the Chinese businessman undertakes not to sell significant amounts of WLFI in order not to collapse the token rate. However, according to analysts, Sun began to look for workarounds: he involved third-party exchanges, split up transactions and actually organized a large-scale “drain”.

The market reacted instantly – the WLFI exchange rate went down, which caused discontent among investors and partners. The reaction of the Trumps was immediate. According to experts, they acted harshly and straightforwardly: in a matter of hours, the blocking of San’s wallets with a huge amount was activated.

A precedent for the cryptocurrency world

Such a measure has become a sensation: it is extremely rare for private individuals to freeze assets of this scale in the crypt. In fact, this is the first time that one influential player has “knocked out” another, citing a violation of the rules of the game. “This is not just a conflict of business interests, but a signal to the market that the era of permissiveness in the cryptocurrency environment is becoming a thing of the past,” analysts say.

For reference: $2.4 billion is an amount comparable to the capitalization of a number of average altcoins. Blocking such a volume of funds effectively excludes San from active operations with WLFI and puts an end to his attempts to put pressure on the price of the token.

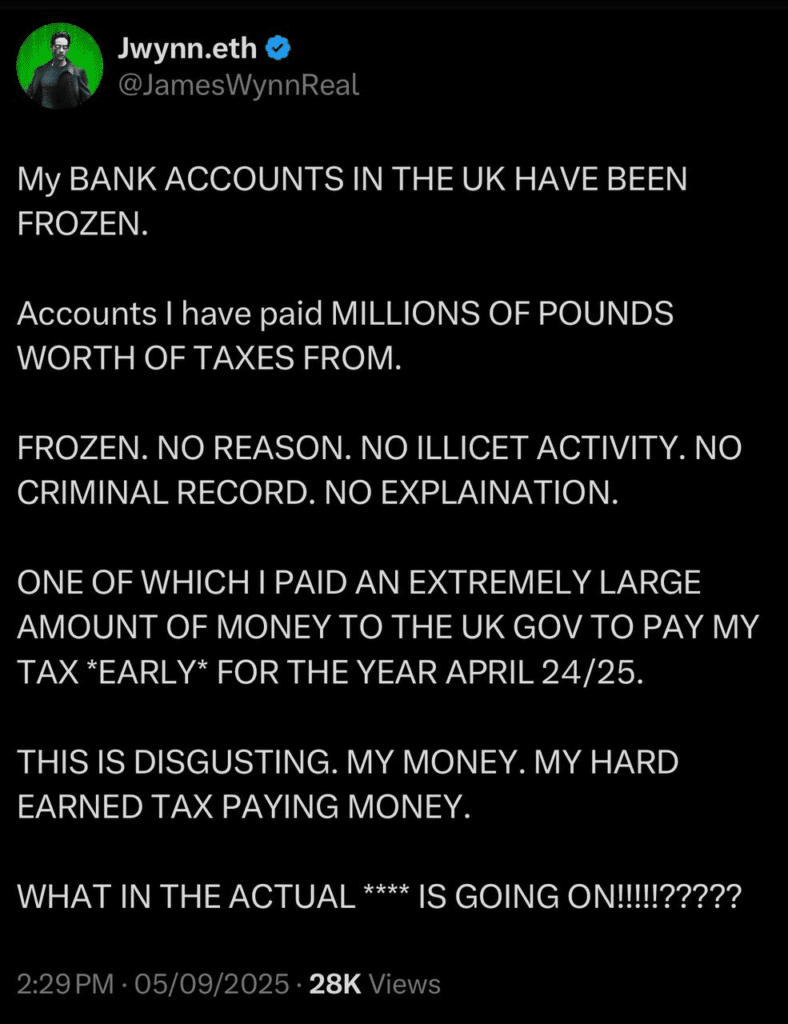

Meanwhile, James Wynn, who is still all-in with his bet on altsys, had his main UK bank account frozen under 115 FZ

According to him, for absolutely no reason.

Justin Sun’s reputation

The figure of Justin Sun has long been controversial in the crypto community. On the one hand, he is known as the founder of the TRON project and as an investor involved in dozens of transactions. On the other hand, he is being accused of fraud, “pump–and-dump” schemes and the use of questionable methods of enrichment.

“He’s a master of gray schemes. He could buy assets through front companies, withdraw profits and leave investors with losses. And all this with a smile and to the applause of a part of the audience,” one of the analysts notes.

Previously, San got away with such actions. But, as noted in the crypto environment, “the sharks couldn’t stand the bigger ones.” In this case, Trump’s structures acted as a “shark”, which, having influence and opportunities, quickly stopped the billionaire’s attempts to play by his own rules.

Consequences and market reaction

The news about the freeze immediately spread across social networks and relevant media. Some crypto enthusiasts greeted the Trump decision with enthusiasm, saying that justice had prevailed. Others express concern: if wallets can be blocked at the will of individual influential players, then where is the principle of decentralization?

Nevertheless, the WLFI market itself reacted positively: after the initial drop, the token’s exchange rate stabilized, and then slowly began to regain positions. Investors saw this as an act of protecting the ecosystem from unfair actions.

The result

The story of Justin Sun’s freezing of $2.4 billion has already entered the history of cryptocurrencies. For some, this is an example of how “senior” players punish violators, for others it is an alarming signal about the centralization of power even where it should not be.

But one thing is for sure: cryptocurrency has long ceased to be the territory of only idealists and enthusiasts. Today, this is a field where the interests of billions collide and where mistakes, even by experienced players, can be very expensive.