Statistics Pocket Option shows that traders who use hedging in their strategies increase income stability by 45% and reduce maximum drawdowns by 2.3 times. At the same time, 73% of novice traders ignore defensive strategies, relying only on the profitability of trades.

Expert research Trading academies based on 28,000 trading accounts over three years have confirmed that proper hedging does not reduce profitability, but makes trading predictable and less stressful. The main thing is to understand the mechanisms of defensive strategies and apply them correctly.

What is hedging and why is it necessary?

Hedging is a risk management method in which a trader opens additional positions to compensate for possible losses from major trades. Simply put, it is a financial insurance policy that works in case of an unfavorable development of events.

The main purpose of hedging is not to maximize profits, but to stabilize trading results. When the market moves against your expectations, hedging positions partially or fully compensate for losses.

Principles of hedging operation:

- Risk compensation: losses on one position are covered by profits on another.

- Reduced volatility: the portfolio becomes less sensitive to sudden market movements.

- Planning: you know in advance the maximum amount of possible losses.

- Flexibility: you can partially or completely hedge a position, depending on the situation.

Hedging is especially important when dealing with volatile assets, during important news events, or when holding long-term positions. This is not a guarantee of profit, but a reliable way to control risks.

A practical example: The trader bought $10,000 worth of Apple shares, expecting growth after the presentation of the new iPhone. To protect himself from a possible fall, he bought a put option on the same shares for $300. If the stock falls by 15%, the loss of $1,500 will be offset by the gain from the put option of $1,200. The total loss will be only $600 instead of $1,500.

How does hedging work in financial markets?

In practice, hedging works by creating positions that move in opposite directions. When the main position suffers losses, the hedging position should make a profit.

Mechanism of action:

- Risk analysis: identification of potential threats to the portfolio.

- Instrument selection: selection of an asset or derivative for hedging.

- Volume calculation: determining the size of the hedging position.

- Monitoring: monitoring the effectiveness of protection and adjusting if necessary.

The mathematical basis of hedging:

The hedging ratio shows how much of the risk needs to be covered. Formula: h = Cov(S,F) / Var(F), where:

- S is the price of the hedged asset.

- F is the price of the hedging instrument.

- Cov is the covariance between assets.

- Var is the variance of the hedging asset.

Perfect hedging (coefficient = 1) completely neutralizes the risk, but also removes the growth potential. In practice, partial hedging is used with a coefficient of 0.3-0.8.

Temporary aspects:

- Short-term hedging: protection for a period of several days to a month.

- Medium-term: hedging of positions for 1-6 months.

- Long-term: protection of the investment portfolio for a year or more.

The effectiveness of hedging depends on the correlation between the underlying asset and the hedging instrument. The higher the correlation, the better the protection.

Types of hedging

There are several classifications of hedging according to various criteria. Understanding the types of defensive strategies will help you choose the right tool for your specific situation.

In the direction of protection

Long Hedge — protection against rising prices of assets that are planned to be purchased in the future. It is used for:

- Waiting for the purchase of shares in a few months.

- Planning investments in commodities.

- Protection against the weakening of the national currency during import.

Short Hedge — protection against falling prices of existing assets. Used for:

- Ownership of a large block of shares.

- Temporary inability to sell a position.

- Waiting for the market correction.

By degree of coverage

Full hedging — protection of 100% of the position. It provides maximum security, but limits profits with a favorable price movement.

Partial hedging is the protection of 30-80% of a position. The optimal balance between security and profitability.

Selective hedging is the protection of only the riskiest positions in a portfolio.

According to the tools used

Futures hedging is the use of futures contracts to protect against price fluctuations. Advantages: high liquidity, standardized contracts, low fees.

Options hedging is the purchase of options to insure positions. It gives the right, but not the obligation, to execute the transaction at a fixed price.

Currency hedging is protection against changes in exchange rates during transactions in foreign currency.

Correlated asset hedging is the use of negatively correlated assets for mutual protection.

Winning strategies using hedging

Let’s consider practical strategies that show high efficiency in various market conditions.

The “Protective Put” strategy

Buying put options to protect long positions on stocks. It works like an insurance policy — when stocks fall, the option compensates for losses.

Application:

- Buy 100 shares of the company for $50 per share ($5,000 total value).

- Purchase a $48 put option for $200.

- When the stock drops below $48, the option begins to make a profit.

- The maximum loss is limited to $400 (a drop from $50 to $48 plus the option premium).

The “Pair Trading” strategy

Simultaneous opening of a long position on one asset and a short position on a correlated asset.

Implementation example:

- Purchase of Apple shares for $10,000.

- Sale of Microsoft shares for $10,000.

- When the technology sector falls, Apple’s losses are partial.

- Offset by profits from a short position on Microsoft

The “Collar” strategy

A combination of a defensive put and a call option sale to minimize the cost of hedging.

Mechanism:

- Owning 100 shares for $100 apiece.

- Purchase of a put option with a strike of $95 for $300.

- Selling a call option with a strike of $105 for $250.

- The net cost of protection: $50 ($300-$250).

- Profits are limited to the level of $105, losses are limited to the level of $95.

Calendar hedging

Using options with different expiration dates to protect positions.

Application:

- Selling a short-term option with a high time value.

- Purchase of a long-term option for basic protection.

- Earning income from the temporary breakdown of a short-term option premium.

What additional tools may be needed

Effective hedging requires the use of various financial instruments, depending on the goals and market situation.

Derivatives

Options are the most flexible hedging tool:

- Put options protect against falling prices.

- Call options insure against price increases.

- Combinations of options create complex defensive structures.

Futures — standardized contracts for future supply:

- High liquidity.

- Low transaction costs.

- The ability to accurately hedge on time and volume.

Swaps — agreements on the exchange of payment flows:

- Currency swaps to protect against exchange rate risks.

- Interest rate swaps for hedging loan portfolios.

- Commodity swaps to stabilize commodity prices.

ETFs and index instruments

Reverse ETFs — funds moving opposite to the underlying index:

- SPXS is a three—fold inverse of the S&P 500.

- SQQQ is a three—fold reverse of Nasdaq.

- Easy to buy and sell like regular stocks.

Sectoral ETFs for risk diversification:

- Gold (GLD) as a protection against inflation.

- Bonds (TLT) as a stable asset.

- Public Utilities (XLU) as a protective sector.

Currency instruments

Currency pairs to protect against exchange rate fluctuations:

- EUR/USD to protect European investments.

- USD/JPY for Asian assets.

- Commodity currencies (AUD, CAD) for commodity positions.

CFDs on currencies — contracts for price difference:

- High leverage for effective hedging of small amounts.

- The ability to trade fractional lots.

- Low spreads on the main pairs.

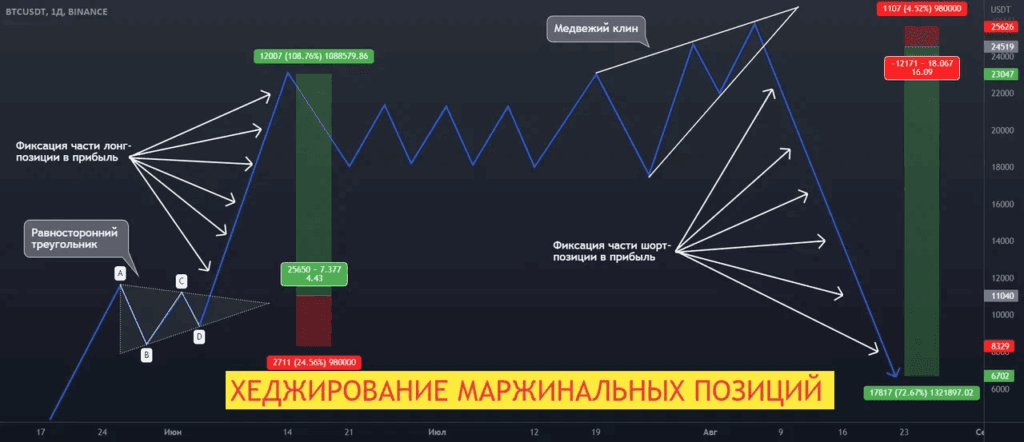

Features of hedging in cryptocurrency

The cryptocurrency market is characterized by extreme volatility, which makes hedging especially important, but also more difficult to implement.

The specifics of the crypto market

High correlation — most altcoins move synchronously with Bitcoin, which complicates diversification within the crypto segment.

Round-the-clock trading — the absence of interruptions requires constant monitoring of hedging positions.

Regulatory uncertainty — changes in legislation can dramatically affect prices.

Effective strategies for cryptocurrencies

Hedging with stablecoins:

- Partial conversion to USDT, USDC upon reaching the target profit.

- Maintaining purchasing power in US dollars.

- A quick return to volatile crypto assets in a favorable situation.

Use of derivatives:

- Bitcoin and Ethereum futures on major exchanges

- Crypto Options for Flexible Risk Management

- Swaps for long-term hedging of large positions

Pair Trading in Crypto:

- Bitcoin (long) vs Ethereum (short) in anticipation of BTC dominance

- DeFi Tokens versus Traditional Cryptocurrencies

- Altcoins of the same sector with different perspectives

Practical recommendations

The size of hedging positions: In cryptocurrencies, it is optimal to hedge 40-60% of the portfolio due to high volatility.

Selection of tools: Give preference to liquid pairs and derivatives with narrow spreads.

Time frame: Short-term hedging (up to a week) is most effective in crypto due to rapid trend changes.

Example of crypto hedging: A portfolio of $50,000 in Bitcoin. When making a profit +30% ($15,000):</ p>

- Conversion of $20,000 to USDT (profit taking).

- Purchase of futures for the sale of Bitcoin for $20,000.

- The remaining $30,000 in Bitcoin for further growth.

- If BTC drops by 20%, the loss will be $6,000 instead of $10,000.

Hedging in traditional markets

Traditional financial markets offer more mature and diverse hedging tools compared to cryptocurrencies.

Stock market

Index hedging:

- Selling index futures (S&P 500, Nasdaq) to protect the stock portfolio.

- Purchase of VIX options to protect against a sharp increase in volatility.

- Using reverse ETFs for quick hedging.

Sectoral hedging:

- Protection of technology stocks through the sale of QQQ.

- Hedging of the energy sector through oil derivatives.

- Pair trading within sectors (Johnson & Johnson vs Pfizer).

The foreign exchange market

Corporate hedging:

- Forward contracts for fixing the exchange rate on a certain date.

- Currency swaps for exchanging interest payments in different currencies.

- Options for asymmetric protection (participation in a favorable movement).

International investments:

- Hedging currency risk when buying foreign stocks.

- Using currency ETFs to accurately cover exposure.

- Cross-hedging through currency correlation.

Commodity markets

Commodity hedging:

- Manufacturers use futures to fix selling prices.

- Consumers are hedging the rising cost of raw materials.

- Investors protect themselves from inflation through gold and other metals.

Energy hedging:

- Oil companies hedge oil prices.

- Airlines are protecting themselves from rising fuel prices.

- Utility companies hedge the cost of gas.

Interest rates

Bond Strategies:

- Interest rate swaps for portfolio duration management.

- Hedging of credit risk through CDS (credit default swaps).

- Protection against changes in credit spreads.

Advantages and disadvantages of hedging

Like any trading strategy, hedging has its strengths and weaknesses that need to be considered when making decisions.

Advantages of hedging

Risk reduction:

- Limiting the maximum losses at a pre-determined level

- Reducing portfolio volatility by 2-3 times

- Protection against systemic risks and black swans

Psychological comfort:

- Reducing stress during adverse market movements

- The ability to sleep peacefully without checking quotes every minute

- Confidence in the controllability of risks

Income stability:

- Smoothing trading results over time

- Predictability of financial indicators for business

- The possibility of long-term planning

Flexibility of management:

- The ability to adjust the degree of protection depending on the situation

- Combining different hedging instruments

- Adapting to changing market conditions

Disadvantages of hedging

Cost of protection:

- Option premiums reduce overall returns

- Derivative fees increase transaction costs

- Spreads and slippages when opening positions

Profit limitation:

- Full hedging excludes participation in a favorable movement

- Possible lost profits with strong market growth

- The need to balance protection and profitability

Complexity of management:

- Requires in-depth knowledge of derivatives

- The need for constant monitoring and adjustments

- The risk of errors in the calculation of hedging ratios

The basic risk:

- Incomplete matching of movements of the hedged asset and the protection instrument.

- Changes in the correlation between assets during crisis periods.

- The impossibility of perfect hedging in real conditions.

When hedging is justified:

- When managing large positions — when the amount of loss can significantly affect capital

- In times of uncertainty — before important news, elections, and central bank meetings

- For business, when currency or commodity risks affect operational activities

- For long—term investments – to protect accumulated profits

When hedging is excessive

- With small positions, the cost of protection may exceed the potential loss.

- In rising markets, hedging reduces profitability in a long—term bullish trend

- For speculative trading, it is better to close short—term positions with stop losses.

- With a lack of experience, improper hedging can increase risks.

Practical recommendations for the implementation of hedging

To use defensive strategies effectively, follow a proven implementation algorithm.

Step-by-step implementation plan

Stage 1. Portfolio analysis- Assess current risks and their sources.

- Identify the most vulnerable positions.

- Calculate the maximum acceptable loss.

- Choose hedging tools for specific risks.

- Compare the cost of different protection methods.

- Take into account the liquidity and spreads of the instruments.

- Test the strategy on historical data.

- Start with small positions.

- Track performance in real-world conditions.

- Gradually increase the size of the hedge.

- Optimize the protection coefficients.

- Automate routine operations.

Key rules for successful hedging

The 10% rule: Do not spend more than 10% of the potential profit of the position on hedging.

The correlation rule: Use tools with a correlation of at least -0.7 with the protected asset.

The rule of time: Hedge your positions in advance, not during a crisis when the cost of protection is at its maximum.

The rule of simplicity: Start with simple strategies (defensive puts, futures) before moving on to complex designs.

Hedging is the art of saving capital, not a way to make money. Properly applied defensive strategies allow traders to work calmly in the market, knowing that their risks are under control. Platform Pocket Option provides all the necessary tools for implementing various hedging strategies, and training materials Trading academies will help you master their practical application.

Remember: the best hedge is the one you never use, but you know it’s there. This gives you the confidence to make bolder trading decisions with a controlled level of risk.