Financial markets live almost according to the laws of physics — sooner or later the energy of movement runs out, forcing the price to change direction. Reversal patterns work like a barometer that predicts a change in market weather a few days or weeks before an event. Statistics Pocket Option demonstrates that traders who have the skills to recognize reversal patterns are ahead of the market by 15-25 trading sessions.

Analysis The Trading Academy has shown an interesting pattern: 87% of major market reversals are preceded by classic graphical formations. At the same time, only 31% of retail traders are able to correctly identify these signals, which creates an information advantage for trained participants.

The key feature of reversal patterns is the ability to show the moment of changing the psychology of the crowd. When optimism gives way to doubt, and fear to hope, the charts record these changes in the form of recognizable formations.

The mechanism of reversal formations

Reversal patterns do not arise by chance — they reflect the fundamental laws of mass psychology and market mechanics. Understanding the principles of their formation helps traders distinguish reliable signals from random fluctuations.

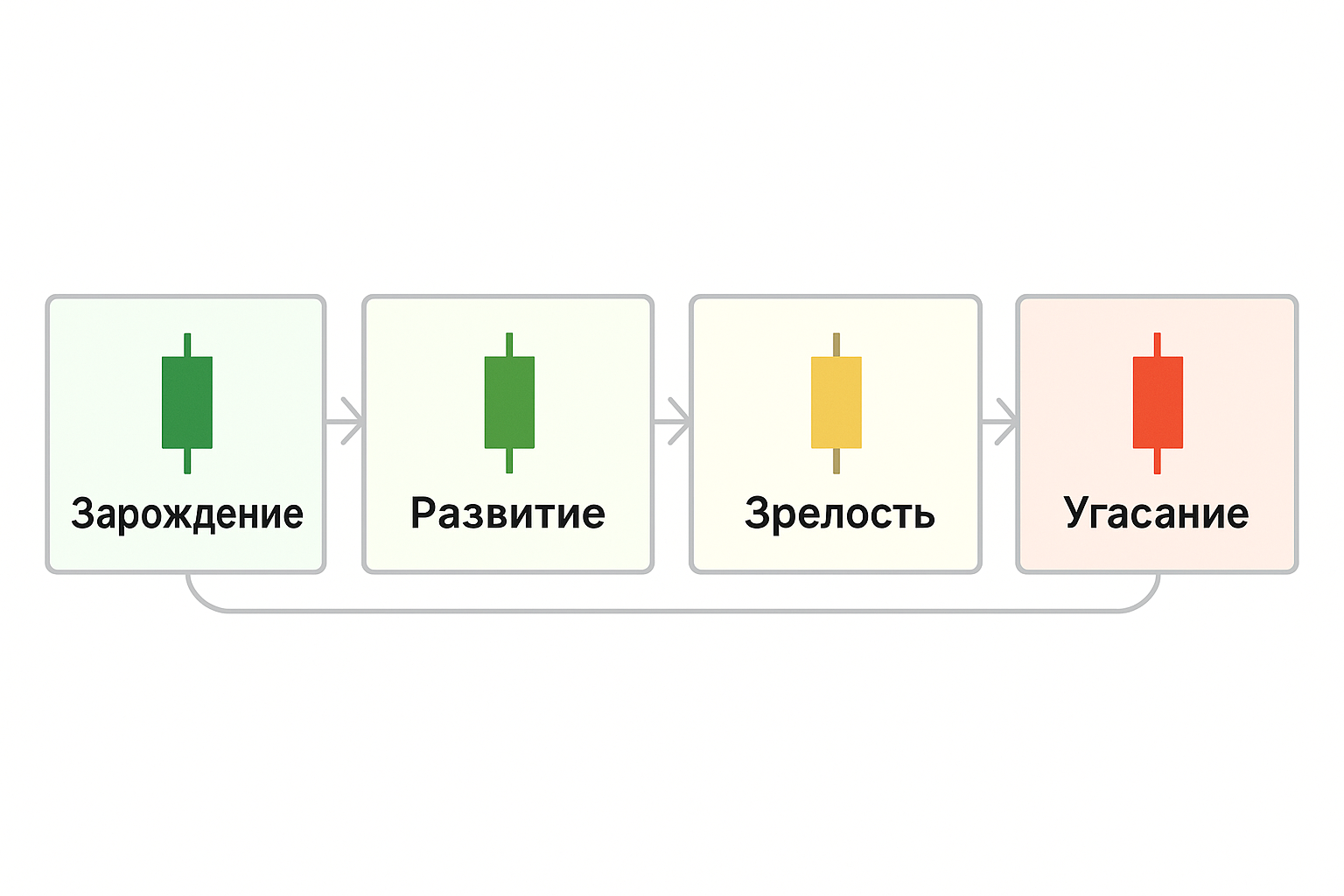

Any trend goes through four stages of its life cycle: origin, development, maturity and extinction. Reversal formations appear at the maturity stage, when the driving forces of the trend weaken. Institutional players are starting to lock in profits, volumes are decreasing, and volatility is decreasing.

The time of the reversal pattern formation is critically important. Fast formations (1-2 weeks) often turn out to be false, slow formations (3-6 months) give more reliable signals. The optimal development period for most reversal patterns is 6-12 weeks.

The physiology of a market reversal includes the following elements:- A decrease in trading volumes by 30-50% from the peak trend values means that institutional players are reducing their activity.

- Reducing the scope of price fluctuations — the daily range shrinks by 25-40% of the average values.

- The appearance of false breakouts in the direction of the trend means that the price loses its ability to move steadily.

- Increased consolidation time — periods of lateral movements become longer than the impulse phases.

- Divergences with technical indicators — RSI, MACD show a discrepancy with the price dynamics.

- A change in the nature of corrections — the pullbacks become deeper and longer.

The psychological component of the reversal is associated with a gradual change in the participants’ moods. In an uptrend, buyers become less aggressive, sellers become more active. The balance of power is slowly shifting, creating the prerequisites for a change of direction.

Institutional players play a key role in the formation of reversal patterns. Large funds cannot instantly change positions due to the size of the capital. The repositioning process stretches over weeks, leaving traces on the charts in the form of characteristic formations.

Classification of reversal formations by structure

Reversal patterns are grouped by the number of peaks or troughs forming a formation. Each category has unique characteristics of reliability, time frame of formation and trading opportunities.

Simple formations consist of a single significant peak or depression. This group includes various variants of spikes, key reversals, and island peaks. Such patterns form quickly (1-3 days), but require immediate confirmation.

Double formations are created by two approximately equal extremes separated by a 15-30% depth correction. Double top and double bottom are classic representatives of this category. Statistics show 74% reliability with correct identification.

Characteristics of the main categories of reversal patterns:- Simple formations — development time 1-5 days, reliability 45-55%, require quick confirmation.

- Double structures — the formation period is 3-8 weeks, efficiency is 70-75%, moderate movement goals.

- Triple formations — 6-16 weeks development, 78-83% reliability, significant movement potential.

- Complex patterns — 3-12 months creation time, 85-90% accuracy, large price targets.

- Wedges and flags — 2-6 weeks formation, 68-72% efficiency, fast signal processing.

The triple formations include a triple top, a triple bottom, and a head and shoulders in all variations. These patterns take longer to develop, but they provide more reliable signals and significant price movements.

Complex formations combine elements of various simple patterns, creating multi-level structures. Such formations are typical for major reversals that change long-term trends. Examples: expanding triangles, diamonds, cups with handles.

Wedges and flags are traditionally considered continuation patterns, but under certain conditions they can signal a reversal. A downward wedge after a long fall often precedes a bullish reversal.

Double tops and bases: mirror formations

A double peak is formed by two approximately equal peaks separated by an intermediate minimum. The pattern demonstrates the inability of buyers to overcome a certain level of resistance when trying again. Psychologically, the formation reflects the weakening of bullish enthusiasm.

The first peak is formed in conditions of a strong uptrend on high volumes. The subsequent correction attracts new buyers who view the decline as an opportunity to enter the market. The second peak is formed at lower volumes, demonstrating a decrease in interest.

The critical element of the double top is the support line drawn through the intermediate minimum. A breakdown of this level activates the pattern and opens the way to a target decline equal to the height of the formation.

Technical requirements for a high-quality double top:- The height of the peaks varies by no more than 3-5% — a large difference weakens the formation.

- The intermediate correction is 15-25% of the height of the previous movement.

- The time between peaks is 4-12 weeks for daily charts, 2-6 months for weekly charts.

- Volumes at the second peak are 20-40% lower than the first, confirming the weakening of consumer interest.

- The breakdown of support occurs on an increasing volume — it demonstrates the seriousness of sellers.

- Retest of the broken level reinforces the bearish signal — the former support becomes resistance.

A double bottom is a mirror image of a double top in a downtrend. Two approximately equal minima are separated by an intermediate maximum. The formation indicates the inability of the bears to break through the support on a second attempt.

Trading strategies for double formations include a conservative entry after the breakdown of a key level and an aggressive one during the formation of the second extreme. The targets are calculated based on the height of the pattern from the breakdown line.

False double formations occur in 25-30% of cases. Distinguishing features: violation of time proportions, inappropriate volumes, formation in an inappropriate market context.

Triple formations: enhanced reversal signals

A triple top is created by three approximately equal peaks separated by two corrections. The formation demonstrates a three-fold failure of buyers to overcome resistance, which psychologically demoralizes bulls and attracts bears.

The statistical efficiency of triple peaks reaches 81%, which is 7% higher than double formations. The increased reliability is explained by the large number of breakdown attempts and the longer formation process.

The time characteristics of triple formations exceed double formations by 1.5-2 times. The full development of the pattern takes 8-20 weeks, which requires patience from traders. Premature entries often lead to stop outs.

Distinctive features of triple reversal formations:- Three peaks are located within 5% of the price range — large deviations violate the symmetry.

- Intermediate corrections reach 20-35% of the movement height, deeper than double formations.

- Volumes are consistently declining from the first to the third peak, reflecting the waning of enthusiasm.

- The formation time of each peak is approximately equal — the time asymmetry weakens the pattern.

- The support line connects the lows between the peaks and may have a slight slope.

- The movement targets exceed the height of the formation by 1.2-1.5 times— which is a greater potential compared to the double ones.

The triple bottom is formed similarly to the top, but in a downtrend. Three unsuccessful attempts to break through the support drain the bears and attract buyers. The bullish potential of a triple bottom often exceeds the bearish potential of a triple top.

The head and shoulders represent a special case of a triple vertex with an asymmetric structure. The central peak (head) exceeds the lateral (shoulders) by 15-30%. This formation is considered one of the most reliable reversal structures.

An inverted head and shoulders is created at the bases of the markets, showing three lows with a deeper central one. Statistics confirm that inverted formations are triggered more often than straight formations by 3-5%.

Wedges and flags as reversal patterns

Wedges are traditionally classified as continuation patterns, but in certain contexts they become powerful reversal signals. The key factor is the wedge’s position in the overall trend structure and the previous price history.

A downward wedge after a long fall often precedes a significant rebound. The narrowing boundaries reflect a decrease in sales pressure and the willingness of buyers to take action. A breakdown of the upper limit activates a bullish scenario.

An ascending wedge at the end of a long-term growth signals the depletion of purchasing power. Slowing growth rates with narrowing borders warn of an imminent reversal. A breakdown of the lower boundary triggers a correction.

Conditions for the transformation of wedges into reversal patterns:- Formation after a movement lasting at least 3-6 months — short trends do not produce reversal wedges.

- Volumes decrease as the formation develops, reflecting the loss of interest of the dominant side.

- The breakdown occurs in the opposite direction to the previous trend.

- The wedge size is 40-70% of the amplitude of the previous movement.

- The formation time is 3-8 weeks for significant reversals.

- The retest of the broken border confirms the trend change.

- Flags can also signal a reversal in a certain

Flags can also signal a U-turn under certain conditions. A bear flag after a long period of growth sometimes becomes the top of the market. A bullish flag in a deep correction may mark the final bottom.

The critical difference between continuing and reversal wedges lies in the context. Continuing formations appear in the middle of the trend, and reversal formations appear at the end of the trend after signs of exhaustion.

Trading strategies for reversal wedges require special care. False breakouts occur in 35-40% of cases. Confirmation of consolidation beyond the boundaries of the formation is critically important.

Volume analysis and confirmation of reversals

Trading volumes provide critical information to confirm reversal patterns. Volume behavior often precedes price changes, giving additional signals about the intentions of participants.

The classic behavior of volumes in reversal formations includes a decrease in activity as the pattern develops, followed by a surge when key levels break. This reflects the loss of interest in the current trend and the activation of the opposite side.

Divergences between price and volume reinforce reversal signals. New price extremes on declining volumes indicate weakness in the movement. Volume growth at constant prices warns of an imminent breakdown.

Volume characteristics of high-quality reversal patterns:- Reduction of average volumes by 25-45% from the peak trend values during the formation process.

- A 1.5-3-fold surge in activity when key support or resistance levels are broken.

- Volume divergence with price at the final extremes of the pattern.

- The distribution of volumes by price levels shows accumulation in the reversal area.

- The change in the nature of volume surges is from trend support to its refutation.

- Institutional indicators record changes in the behavior of major players.

The Volume Profile helps to identify the accumulation and distribution zones of institutional positions. High-volume areas often become magnets for the price during reversals.

On-Balance Volume (OBV) and similar cumulative indicators show divergences ahead of price signals. The discrepancy between OBV and the price in the area of a potential reversal increases the likelihood of a trend change.

The analysis of intraday volumes reveals the struggle between the participants. High volumes at the beginning of the session with fading towards the close indicate a lack of conviction. The increasing volumes towards the close demonstrate determination.

False breakouts and protection against deceptive signals

False breakouts are the main threat for traders trading reversal patterns. Statistics show that 30-40% of initial breakouts turn out to be false, which requires special protection measures.

The reasons for false breakouts include manipulative actions by major players, low liquidity at the time of announcements, and technical positioning of algorithms. Understanding the mechanisms helps to avoid pitfalls.

The time factor plays a key role in separating true breakouts from false ones. Breakouts in the first 30-60 minutes of a trading session often turn out to be false due to low liquidity and positioning at the opening.

Signs of a potentially false breakdown of the reversal pattern:- The breakdown occurs at low volumes — less than 75% of the average over the period of the pattern formation.

- Lack of anchoring to a key level during 2-3 trading sessions.

- An immediate return to the boundaries of the formation without testing the broken level.

- The breakdown coincides with low-liquid trading periods or holiday sessions.

- Technical indicators do not confirm the price signal.

- The fundamental background contradicts the direction of the breakdown.

Strategies to protect against false breakouts include waiting for confirmation, using buffer zones, and multi-level inputs. Conservative traders are waiting for a retest of the broken level, aggressive traders use partial entries.

Buffer zones are created with an offset of 1-3% from the key levels of the pattern. This protects against short-term disruptions caused by technical factors or low liquidity.

Multilevel inputs involve opening a position in parts: 30-40% at the initial breakdown, the rest at confirmation. This approach reduces the average risk and increases psychological comfort.

Conclusion

Reversal patterns remain one of the most powerful tools of technical analysis, allowing you to look into the future of market movements. As an experienced doctor determines a disease by symptoms, a professional trader predicts a trend change using graphical formations.

Mastering the art of recognizing reversal patterns opens up new opportunities for earning and protecting capital. Pocket Option provides professional graphical tools for studying patterns at any time interval. The demo mode allows you to safely practice formation identification skills.The path to mastery requires constant practice and study of market history. Community The Trading Academy unites graphical analysis specialists who are ready to share their experience with reversal formations and discuss the intricacies of their practical application in modern market conditions